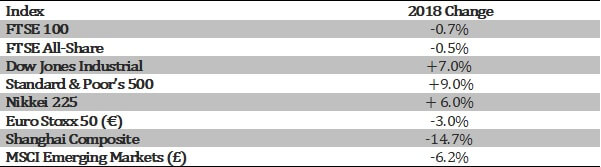

The third quarter of 2018 showed mixed results for global stock markets.

In the US, shares have continued to power ahead, despite another rise in interest rates in late September and Mr Trump’s trade battles. It has been a different story in emerging markets, which have suffered from two key US factors: a strong dollar and those rising interest rates.

Japan has also performed well, with the Nikkei 225 reaching a 27-year high at the end of September. Meanwhile, Europe ended September on a down note, with worries about Italian government borrowing resurfacing just as the month closed. And for all the traumas of Brexit, the UK is marginally ahead of the rest of Europe across the first nine months of the year.

The mixed performances of the main markets serve as a reminder of the importance of asset allocation, and the dangers of focusing too heavily on the home market.

The final quarter of 2018 could provide a similar lesson, as another rise in US interest rates is expected, further supporting the dollar. The Brexit negotiations are also entering the final stages, which could have unpredictable effects on markets.

As ever, if you would like to discuss your investment options please get in touch.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.