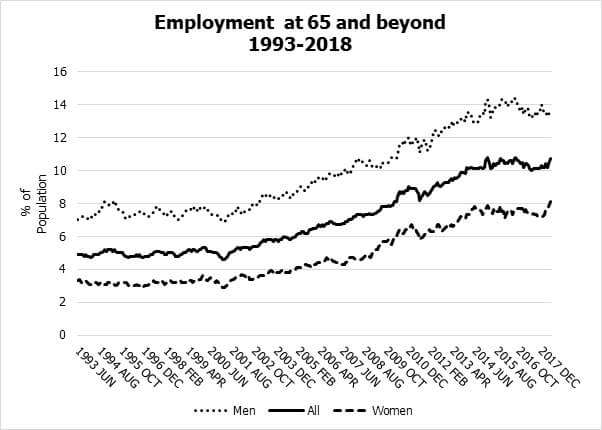

Do you fancy working once you have reached age 65? The trend of rising employment levels is not limited to working-age people, according to the latest employment statistics from the Office for National Statistics.

Source: ONS 11/9/2018

The data reveals a growing number of people are working beyond what is still often thought of as male pension age since the start of the millennium. From May to July 2018, 10.7% of the population aged 65 or over were in employment. Women aged 65 or over are less likely to be working, but the proportion who are has increased to 8.1% from 4.7% in July 2008.

In fact, 65 will be women’s state pension age (SPA) from November 2018, but only briefly. From December 2018 the next phase of SPA increases begins, reaching a SPA of 66 for both men and women by October 2020. These increases, with yet more rises by March 2028, make it almost certain the percentages will increase further.

Not everyone in work beyond age 65 is forced to do so for financial reasons. Some people enjoy work and there is a good case for saying a phased retirement is better than the traditional cliff edge approach.

Whichever camp you fall into, keeping your options open is important. Just because you currently think you will want to keep on working in your late 60s does not mean that your health, personal or economic circumstances will allow that to happen.

If you have not reviewed your retirement planning recently or just want to know when you will eventually see your state pension, you should check now. Late planning could lead to deferred retirement.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance

Content correct at time of writing and is intended for general information only and should not be construed as advice.