Two recent events have shone different lights on the government’s view of unmarried couples.

Source : Office for National Statistics

Source : Office for National Statistics

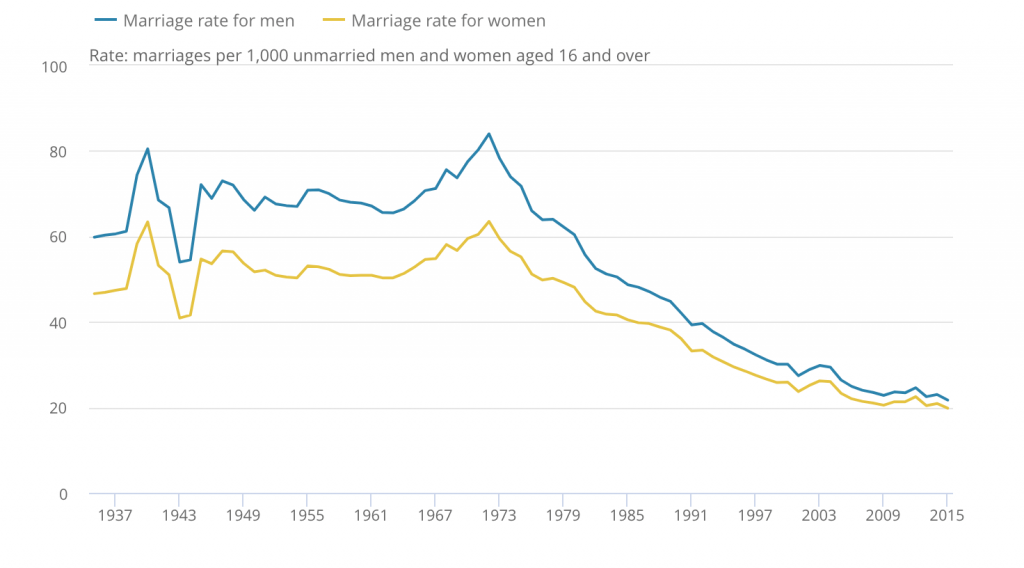

As the graph shows, marriage has been drifting out of fashion for close to 50 years. There are now over 3.3 million unmarried couples in the UK, of which nearly half have children.

In spite of this major social change, governments have largely maintained sharp legislative distinctions between the married and unmarried. When they have conflated the two, it is usually to swell the Exchequer’s coffers, for example when applying the high income child benefit charge to unmarried couples with children.

This approach is starting to be challenged in the courts:

- In October, the Prime Minister announced at the Conservative Party conference that civil partnerships legislation would be extended to cover heterosexual couples. The announcement came after a June ruling from the Supreme Court that limiting Civil Partnerships only to same sex couples was in breach of the European Convention on Human Rights (ECHR).

- In a judicial review case in August, the Supreme Court found the government was wrong to deny an unmarried mother her claim for widowed parent’s allowance, again referring to the EHCR in the decision. The Department for Work and Pensions’ response was that the judgement did not affect the eligibility regime for bereavement benefits, which replaced the widowed parent’s allowance for new claimants in April 2017.

If you are one of the 3.3 million unmarried couples, these decisions serve as a reminder that your status is very different from that of a married couple. Given the DWP’s stance, you could need more life and health protection than if you were married.

You will also potentially require a different approach to estate planning, as transfers on death to your partner, such as your interest in the family home, will not benefit from the inter-spouse inheritance tax exemption.

If you would like advice on how to plan for your family, please get in touch.

The Financial Conduct Authority does not regulate tax or trust advice and some forms of estate planning.

Content correct at time of writing and is intended for general information only and should not be construed as advice.