The popular National Savings & Investments (NS&I) savings certificates will be indexed to CPI instead of RPI from next year.

The certificates have not been on sale since 2011, but NS&I allow existing certificate holders to reinvest in new series of certificates when their old ones mature. The terms have gradually worsened over the years and at present reinvestment promises a return of RPI inflation +0.01% a year. For certificates maturing from 1 May 2019, the basis of indexation will change from RPI to CPI.

The change was not picked up by newspapers at the time because it was released the Friday before the 2018 Budget, held on the Monday. Government departments are often accused of burying bad news, and the downgrading of the NS&I index-linked savings certificates is certainly bad news for affected investors.

RPI or CPI?

The government now generally only uses RPI where it benefits, for example as the basis for interest levied on student loans or for annual rail fare increases. CPI is used to index many – but not all – income tax bands and allowances.

NS&I said, ‘This change recognises the reduced use of RPI by successive governments and is in line with NS&I’s need to balance the interests of its savers, the cost to the taxpayer, and the stability of the broader financial services sector.’

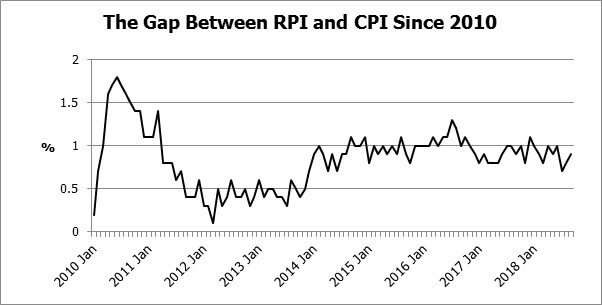

As the graph shows, the move from RPI to CPI will cut returns by about 0.8% a year based on data since 2010. In their widely-missed press release, NS&I note that, ‘The cost to the taxpayer is forecast to reduce by £610 million over the next five years’. That ‘cost to the taxpayer’ could also be read as ‘return to the investors’.

If you hold any issues of index-linked certificates, think about whether you definitely want to reinvest when they next mature, rather than letting inertia (and automatic reinvestment) take its course.

For more information about our investment service click here

Content correct at time of writing and is intended for general information only and should not be construed as advice.