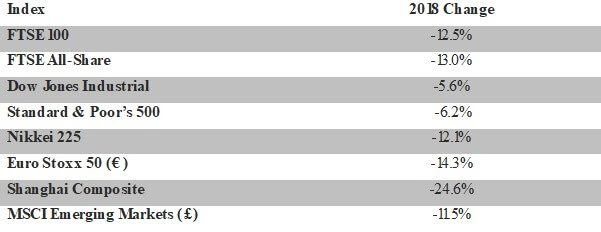

The world’s share markets mostly saw falls in 2018.

2018 was a very different year for investors from 2017. During that year, the share markets generally produced positive returns with very little volatility. Both years had their fair share of dramas, with Brexit and Donald Trump sources of concern across the 24 months. However, whereas in 2017 stock markets seemed relatively unphased by events, the opposite was true in 2018.

In sterling terms, the MSCI World Index was down 4.9%, much less than the main UK indices. However, this hides two factors:

- The US stockmarket, which forms about half of the World Index, was relatively strong. Strip that out and the MSCI World Index ex-USA was down 11.2% in sterling terms, only marginally less than the main UK indices.

- The Brexit-battered pound was weak during 2018, which flattered overseas returns.

In the UK, the main indices produced their worst annual return since the financial crisis year of 2008. As a result, the UK stock market now has an average dividend yield of nearly 4.5%, the highest level since 2009.

If you are investing for income that yield is undoubtedly attractive. We’re always here to discuss your portfolio and options – and 2019 is going to be an interesting year.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.