Investment in Venture Capital Trusts (VCTs) is continuing to rise as we head in to 2019/20.

What Are Venture Capital Trusts?

A Venture Capital Trust (VCT) is a listed company that mainly invests in smaller companies not quoted on the London Stock Exchange. Investments in Venture Capital Trusts are considered to be high-risk due to the money being invested in smaller companies, which leads to certain tax reliefs as an incentive.

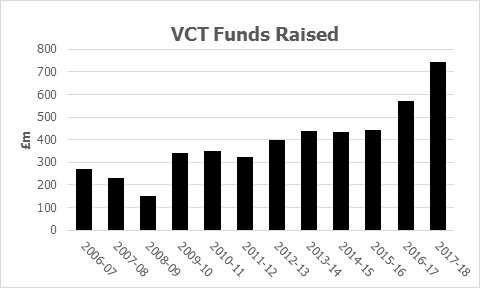

Venture Capital Trusts have been growing in popularity in recent years, as the graph shows. Nearly £750 million was invested in VCTs in 2017/18, the highest figure since 2005/06, when the rate of income tax relief was temporarily boosted to 40% (against the current 30%).

There were two main reasons for the surge in Venture Capital Trust popularity in the past couple of years:

- Tax Relief: The restrictions on the pension lifetime allowance and the annual allowance have meant that an increasing number of high earners have been seeking alternatives to pension contributions. With HMRC taking an ever-stronger stance towards tax avoidance schemes, VCTs are one of the few areas outside pensions where tax relief is available with a government stamp of approval.

- New Investment Restrictions: Last summer the Treasury published a consultation paper on ‘patient capital’ that indicated new investment restrictions for all venture capital schemes. These details were confirmed in the 2018 budget, but by then many VCTs had raised substantial funds helped by a buy-now-while-stocks-last message.

New restrictions on Venture Capital Trust investments:

The revised investment rules need to be borne in mind if you are thinking about investing in VCTs to reduce your 2018/19 tax bill, because they have made investment in VCTs more risky.

The Finance Act 2018 says that when a Venture Capital Trust invests in a company there must be “a significant risk that there will be a loss of capital of an amount greater than the net investment return”. It is therefore all the more important to choose your VCT provider(s) with care. An existing track record may have been based on an investment approach which would not satisfy the Finance Act 2018 rules.

For information on the VCTs* currently available, please talk to us. Despite the risks, the tax advantages mean that the more attractive issues can disappear within days. You can get in touch with us here or give us a call on 0345 300 6256.

The value of tax reliefs depends on your individual circumstances.

Tax laws can change.

The Financial Conduct Authority does not regulate tax or trust advice.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

*VCTs are high risk investments and there may be no market for the shares should you wish to dispose of them. You may lose your capital.

Content correct at time of writing and is intended for general information only and should not be construed as advice