The importance of China’s stock market is set to quadruple in 2019.

China has been at the forefront of the headlines recently, whether about the protracted trade dispute with the US, the alleged dangers of using Huawei’s 5G equipment or the first landing of a spacecraft on the far side of the moon. The ‘Middle Kingdom’, as China is sometimes called, is now the world’s second largest economy. If you adjust for the Chinese currency’s purchasing power – not something the Chinese like to do – their economy comes out at number one.

For all its apparent might, China remains classified as an ‘emerging market’ in investment terms. The overall economy may be at, or close to, the top of the charts, but when you look at economic output per head, China drops down to a ranking into the 70s – much the same as Bulgaria. That difference in ranking underlines the degree of China’s scope for growth.

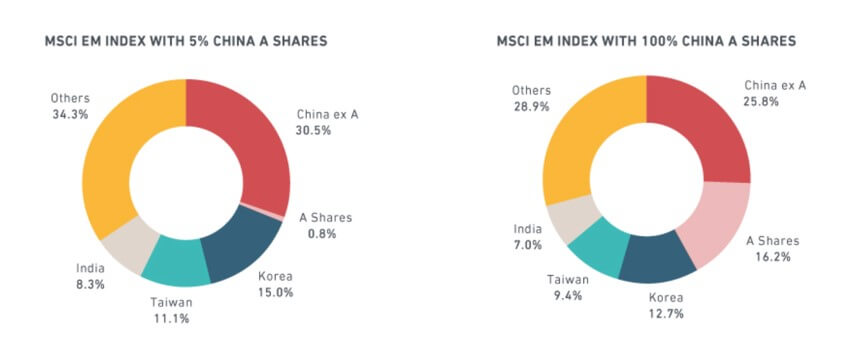

In March, China’s economic status gained another leg up with an announcement from MSCI. The MSCI Emerging Markets Index (EMI) sets the benchmark for an estimated $1,900bn of funds investing in emerging markets and included shares listed in China (so-called ‘A Shares’) for the first time in 2018. Previously it had only included shares in Chinese companies listed outside China, such as Alibaba, which is listed in New York. The 2018 move was an initial step, as MSCI only gave a 5% weighting to the A Shares, meaning that they formed a miniscule part of the EMI.

MSCI’s March 2019 announcement heralds a staged increase in that weighting, which will reach 20% by November, at which point A shares will be 3.3% of the EMI. Further increases are possible later, subject to market developments in China. If – and it is a big if – China A shares eventually gain a 100% weighting, then Chinese companies (wherever they are listed) will account for over 40% of the EMI, up from 31.3% currently, as the chart below shows.

The MSCI move on China is prompting many emerging market investment managers to reassess their Chinese holdings, probably with a view to increasing them. If you want to add to or create your exposure to Chinese investments, there are a variety of options that we would be happy to discuss. If you want to avoid China, then make sure you have a good reason why – it looks set to become ever more important for investors across the globe.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice