A Freedom of Information (FoI) request has revealed a gap in HMRC’s knowledge about how many people have been hit with penalties around the annual allowance.

The annual allowance, which effectively sets the tax-efficient ceiling on annual pension contributions, used to be a subject of little interest, even among pension professionals. When it started life in 2006 at £215,000, it was of limited relevance beyond a small minority of highly paid executives.

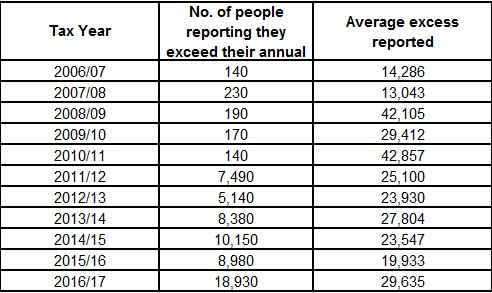

These days the annual allowance is one of the most contentious aspects of pension legislation. The table below, using data provided under an FoI request published at the start of this year, helps to explain why.

While the taper rules for the annual allowance have been causing many problems in the public sector, for example the widely reported issues among NHS consultants, there is another aspect of the annual allowance rules which has just had a light shone on it by the new FoI request.

Withdrawing income

Since 2015/16 there has been a reduced allowance – the money purchase annual allowance or MPAA– which applies, regardless of income level, as soon as you first draw retirement income using pension flexibility. To enforce this, the law says that within 31 days of starting flexible income, your provider must supply you within a ‘flexible access statement’. You then have 13 weeks to inform any money purchase scheme to which you or your employer are contributing. Failure to do so is subject to penalties of an initial £300 plus further amounts of up to £60 a day until HMRC are notified.

The FoI request asked a simple enough question: how many people had suffered the penalties? HMRC’s reply was that it did not have an answer and it would be too costly for it to find out.

Whatever you feel about that response, it is a reminder of how complex the rules for pension contributions have become, even for those who police them. The safest course of action is to seek expert advice before making any change to your pension arrangements to make sure you don’t become an under-reported casualty.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

Content correct at time of writing and is intended for general information only and should not be construed as advice.