Recent data show that dividends from UK shares rose by nearly 7% year-on-year in the third quarter.

Source: Link Asset Services

The latest Dividend Monitor from Link Asset Services, the share registrars, shows that dividends from UK shares continued to grow faster than inflation in the third quarter of 2019, despite all the political turmoil the UK experienced over those three months.

Compared with the same quarter in 2018, total UK dividend payments rose by 6.9% to a new third quarter record of £35.5bn. Link attributed the increase to a variety of factors, including:

- A near 300% increase in special (one-off) dividend payments. These included a £1.1bn special dividend payment from the Royal Bank of Scotland to its major shareholder, the UK government.

- A 29% increase in payments from companies in the mining sector, which is now second only to the banking sector in terms of the value of dividends paid.

- Foreign exchange gains on dividends declared in US dollars and euros added 2.6% to the overall dividend growth figure, the flip side of adverse impact of political uncertainty on the pound.

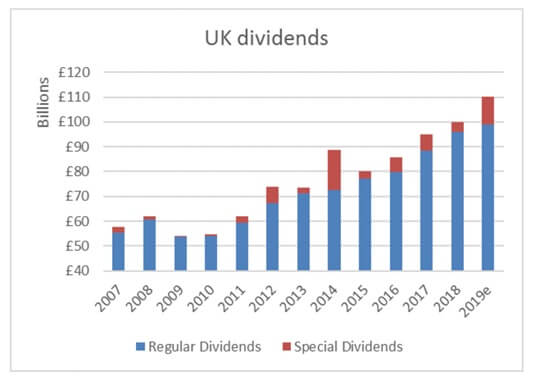

As the graph shows, Link estimates that total dividend payments in 2019 will exceed £100bn for the first time, rising 10.4% above last year’s outturn. The importance of special dividends to achieving that growth is highlighted in the different heights of the red columns in 2018 and 2019.

Two of those driving factors for 2019 dividend growth – exchange rate movements and one-off payments – could reverse direction in the coming year. Link suggests that if these two elements were removed from the calculations, the trend for dividend growth would be ‘flat or low single-digit increases’.

On the other hand, the upward trajectory is not expected to last. Link expects shares to yield 4.4% over the next 12 months, excluding any special dividends. But as it notes, ‘By comparison, the yield on UK government bonds dropped to just 0.49% in Q3, while residential property and savings rates were flat. Equities, once again, continue to deliver far more income for every £1 invested than any other asset class’.

As ever, a balanced portfolio and regular advised reviews should keep your investments on track.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.