Inflation has fallen to its lowest level in almost three years, but you should still take it into account.

Source: ONS

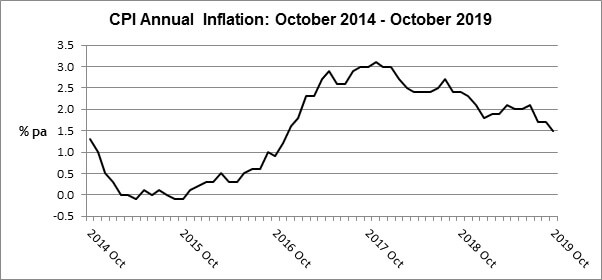

The October measure of annual inflation was lower than most experts had expected. At 1.5% on the CPI yardstick, it was the lowest since November 2016 and 0.5% below what is still the Bank of England’s central target of 2.0%. Ironically, the main reason behind the fall was a government price control, which began at the start of the year: the utility price cap.

This now operates on a half yearly cycle, with the cap reset on 1 April and 1 October by OFGEM, the utility regulator. The fall in the annual CPI rate reflected the latest October adjustment, which produced a theoretical dual fuel price cut of 6% for the ‘typical customer’ on default rates.

Of course, what the regulator gives, the regulator can just as easily take away – the April 2019 review resulted in an average 10% increase in the cap. Either way, it is a reminder that behind the headline inflation number, there are many factors at work, often pulling in opposite directions at different times.

Cumulative effect

While inflation is now relatively low, it remains an important factor in financial planning, not least because of its cumulative effect. Over the last five years, the period covered by the graph, prices rose by 7.9%, while over the last ten years prices increased by almost a quarter at 24.2%. Unless your financial planning is regularly reviewed to take account of inflation, you could find that it gradually becomes outdated.

At this time of year, as the new year approaches, it is a wise idea to look at any fixed components of your planning, such as life assurance cover, income protection or regular pension savings, and consider whether they need to be increased to counter the effect of inflation. Do talk to us before taking any corrective action as it might be better to start afresh rather than make an incremental increase to an existing arrangement.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Content correct at time of writing and is intended for general information only and should not be construed as advice.