The Bank of England’s two unscheduled base rate changes in March took interest rates to a new all-time low.

The Bank of England’s 0.5% cut in its base rate to 0.25% on Budget Day (11 March) was far from being a complete surprise. The previous week had seen its US counterpart, the Federal Reserve, make its own 0.5% cut in response to worries about the impact of Covid-19 on the global economy. The Bank of England’s cut was accompanied by other technical measures to facilitate lending to small and medium enterprises as the Chancellor announced a raft of provisions to deal with the pandemic.

Four days later, on a Sunday evening, the US central bank announced another 1% cut in interest rates, taking them down to 0.00%–0.25%. On 19 March the Bank of England returned with its own interest rate scissors, snipping a further 0.15% off the base rate, taking it down to 0.1%.

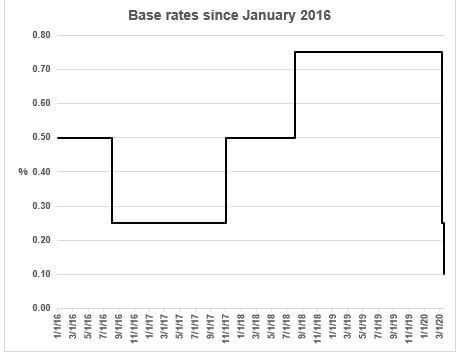

As the graph shows, the UK base rate is now below the 0.25% level set in the aftermath of the Brexit referendum result in summer 2016, where it remained for over a year. What happens on this occasion will depend on how long and how deep the economic impact of Covid-19 will be. The former governor of the Bank of England, Mark Carney, had long expressed a view that negative interest rates would not suit the UK and his successor, Andrew Bailey, is unlikely to disagree.

As demonstrated on 11 and 19 March, the Bank of England has other weapons in its armoury alongside interest rates. For example, it has restarted quantitative easing (QE) – often erroneously described as printing money – and relaunched its cheap loan programmes to commercial banks, conditional upon them lending on to businesses rather than using the funds for consumer finance or residential mortgages.

For some while the mantra on interest rates has been ‘lower for longer’; now it almost seems ‘lowest forever’. That has potential ramifications for many aspects of your financial planning, including retirement income and long term investment.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Content correct at time of writing and is intended for general information only and should not be construed as advice.