The latest statistics on ISAs have emerged, showing nearly £270bn is held in cash.

Individual Savings Accounts (ISAs) reached their 20th birthday in April last year. Somewhat belatedly, HMRC has now issued ISA statistics up to April 2019. These reveal some surprising – and not so surprising – facts about ISAs:

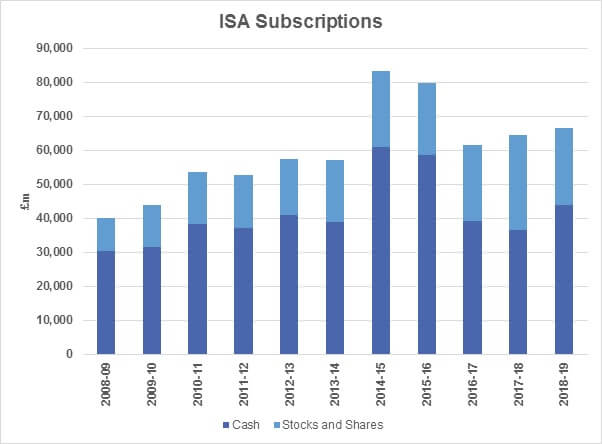

- Overall ISA subscriptions in 2018/19 were almost a fifth lower than in 2014/15.

- Cash ISAs accounted for 46% of all the value held in ISAs as at April 2019, despite the ultra-low interest rates on offer.

- In 2018/19, 65% of all new ISA subscriptions were made to cash ISAs.

- In the three years to April 2019, the amount of cash held in ISAs was virtually unchanged, suggesting that subscriptions and interest were just about matched by withdrawals.

- Similarly, in the two years to April 2019, the total value of stocks and shares ISAs was down by 0.3%, also pointing to withdrawals matching investment returns plus fresh subscriptions.

- Lifetime ISAs have not been a great success, accounting for less than 1% of all ISA subscriptions in 2018/19.

There are two good reasons why ISAs have waned in popularity:

The personal savings allowance of up to £1,000, introduced in April 2016, combined with low interest rates means that many savers do not need a cash ISA to avoid paying tax on interest.

The dividend allowance, introduced alongside the personal savings allowance, exempts £2,000 of dividends from tax, so for many investors in share-based funds, an ISA offers no income tax savings.

But ISAs still have an important role to play in financial planning, particularly if your investment income already exceeds your available allowances or you regularly use your capital gains tax (GCT) annual exemption (£12,300 in 2020/21).

In the past, the tax advantages of ISAs meant they were often regarded as buy-and-forget investments. If you have ISAs that fall into that category, blow the dust off them and take a look at how they are performing, or ask us to review them. Market-topping bonus interest rates and flavour-of-the-month funds can lose their attractions over the years.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at time of writing and is intended for general information only and should not be construed as advice.