New research shows the majority of the self-employed are not saving for retirement.

Here’s a quick quiz:

- Are you self-employed?

- If so, have you contributed to a private pension in the last year?

The Institute for Fiscal Studies (IFS) examined the answers to these two questions and found the probability of answering yes to both is much the same. Drawing on government data, the IFS calculated that in 2018:

- 15.1% of the UK workforce – some 4.8 million people – were self-employed.

- Just 16% of the self-employed contributed to a private pension.

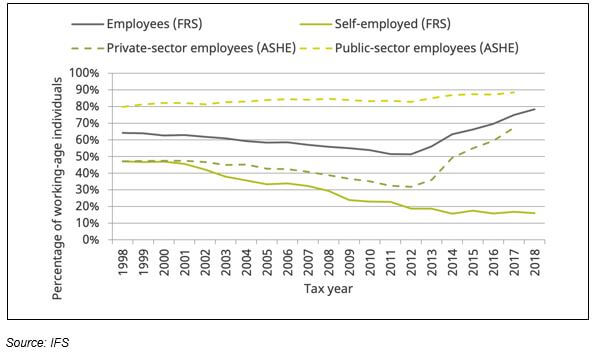

As the graph shows, the proportion of pension contributors among the employed and self-employed workforce was on a steady decline from 1998 until 2012. In October 2012, pension automatic enrolment was launched, and by March 2019, over 10 million workers had joined a workplace pension arrangement. The self-employed were left out of auto-enrolment, hence the sharp divergence of the employee and self-employed lines from 2012 onwards.

The IFS research struggled to establish why only one in six of the self-employed were saving in a private pension, two thirds less than 20 years ago. It found that the characteristics of the self-employed workforce have changed over that period – it now consists of more females, an older demographic and an increase in part-time workers – but none of these factors were enough to account for the fall in pension contributions. Given the tax relief which pension contributions attract, one surprising discovery was that the largest decline in self-employed contributions came from the higher-income bracket and the long-term self-employed.

If you answered yes to the first question and no to the second, then you may be expecting the state pension to make up the largest slice of your retirement income, a view shared by more than a quarter of the self-employed. At present, the state pension amounts to £175.20 a week. If that sounds like a less than comfortable retirement plan, perhaps you need to rethink the answer to that second question…

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.