Interest rates matter. At the personal finance end of the spectrum, they determine what you earn from bank deposits (virtually nothing at present) and what interest you pay on your mortgage (about 4.4% if you are paying the average standard variable rate (SVR), but much less for most other loans). In the investment and commercial world, interest rates determine what business borrowers pay and are often the basis for valuing assets, from shares to property.

While the primary focus in the UK is the rate set by the Bank of England (0.1% at the time of writing), it is not the most significant interest rate for professional investors. The Bank of England rate is a driver of short-term rates in the UK, although they are currently very similar to the corresponding rates from the US, European and Japanese central banks.

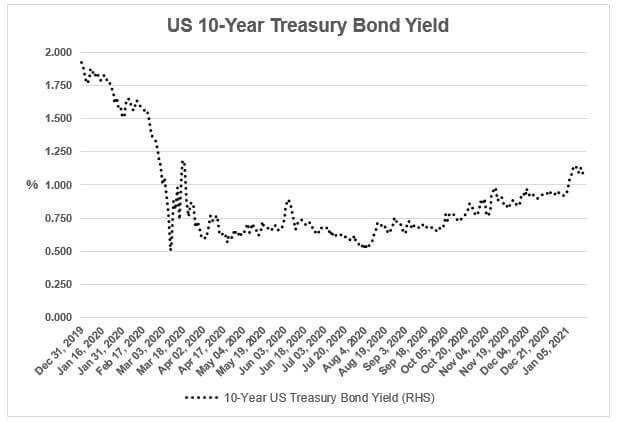

The professionals’ focus is generally longer term and in particular on the yield of the US Treasury 10-Year Bond.

Although the US no longer has the top AAA rating as a borrower, the 10-year T-Bond, as it is often called, is widely regarded as the benchmark for long-term, risk-free returns. That is not to say it is without risk: like all government bonds, its price fluctuates over time and payment of both interest and at maturity depend upon the issuing government. However, even in the Trump era, there were few suggestions that the US would ever renege on its debts.

As the graph shows, the T-Bond yield had a rollercoaster ride in the first few months of last year, falling from 1.92% at the start of 2020 to a low of 0.502% in early March as concerns about the pandemic rattled markets. By mid-January 2021, the yield had more than doubled to around 1.1%.

So far, the rise in the yield has not affected the US stock market, despite the fact that it has increased the relative attractiveness of government bonds to shares. US investors expect an economic recovery in 2021, which gives support to share values. If that bounce-back falters, the security of the T-Bond could once again come to the fore. It is a point to watch if you are contemplating where to place this year’s ISA cash.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.