Research from the Bank of England has shown that many people have built up excess cash savings during the pandemic.

This has been driven by a large reduction in household spending. A Bank of England survey has also shown that about 70% of households plan to keep these extra savings in their bank accounts, even though most savings accounts are paying very little in the way of interest. Does this apply to you and, if so, could your extra cash savings be put to better use?

A House of Commons report, ‘Coronavirus: impact on household debt and savings’, published in January 2021, highlighted huge increases in the household savings ratio as a result of the pandemic. This ratio, which shows household savings as a proportion of household disposable income, increased from 9.6% in Q1 2020 to a whopping 29.1% in Q2 2020. This second figure is a record high since these figures started to be recorded in 1987. The quarterly increase was driven by a large decrease in household spending of some £80.5 billion, as lockdown measures prevented expenditure on many non-essential items.

The Bank of England’s Monetary Policy Report published in February 2021, states that the household savings ratio fell back to 16.5% in the third quarter of 2020, but this was still some 9 percentage points higher than the 2019 equivalent. Data on retail deposits suggest that in each month between March and November 2020, more money went into households’ bank accounts than usual. Adding up the additional deposits over those nine months, the Bank of England predicted that households accumulated excess cash savings of £125 billion. They added, “that figure is likely to rise substantially further over the first half of 2021”.

To put this £125 billion of excess cash savings into context, between 2012 and 2019 the highest amount of equivalent savings accumulated over any nine month period was around £25 billion. The Bank of England estimated that there is now £1.6 trillion in household cash deposits.

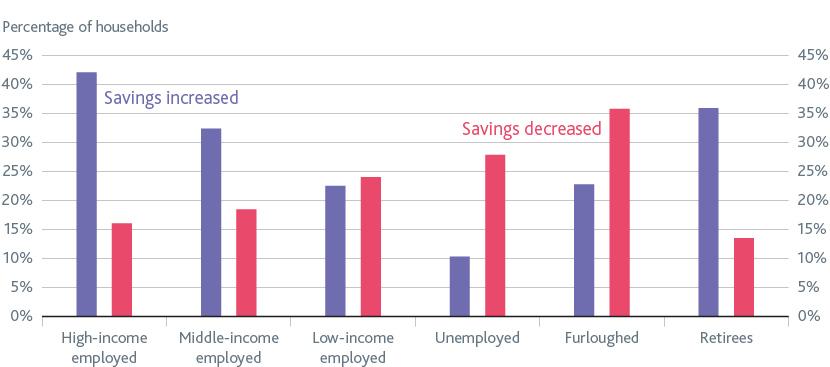

The NMG Household Survey, which is conducted by the Bank of England, predicts that a significant share of accumulated savings may not be spent immediately. The survey suggests that 10% of the households that increased their savings during the pandemic planned to spend at least part of the money they had saved, with around 70% planning to continue to hold the savings in their bank accounts. The survey highlights that higher earners and those who are retired have been the groups who have accumulated the most excess cash saving savings, as you can see in the chart.

Source: NMG Household Survey H2 2020 and Bank of England calculations.

If you have built up additional cash savings that you don’t need in the short-term, and which could potentially be put to better use, then please speak with your Chase de Vere adviser.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.