A recent Upper Tribunal case has raised questions about HMRC’s approach to collecting tax on child benefit.

Child benefit tax, or the High-Income Child Benefit Charge (HICBC) to use its legal name, has a chequered history. The HICBC was introduced in January 2013 as a mechanism for clawing back child benefit from high-income couples, whether married or not. From 2013, the definition of ‘high income’ has been that one (or both) of the couple has adjusted total income of over £50,000. If both cross the threshold, then the person with the highest income pays the tax.

When the HICBC was introduced, it only affected higher-rate taxpayers, but now that £50,000 threshold can also catch basic-rate taxpayers. The highest income approach means that a couple who have an evenly split income of £100,000 pay no HICBC, but their neighbours, with £60,000 of income all in one partner’s name, face the full force of the charge.

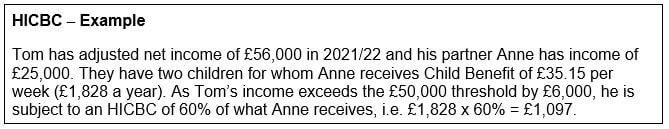

The way that HICBC is levied is unusual. The charge is calculated as 1% of the child benefit received for each £100 of income above £50,000 as the example below shows.

Although an income tax charge, technically the HICBC is not a tax on income. This distinction may seem to be arcane, but in a recent case heard by the Upper Tribunal, it meant that HMRC lost its appeal. The tribunal found that a ‘discovery assessment’, one of HMRC’s common methods of collecting HICBC from those who have not completed a self-assessment return, was invalid because it could only be used for tax due on income. There is now a major question mark over HICBC already paid by taxpayers caught by discovery assessments.

If you are within the scope of HICBC, the latest case is very unlikely to affect your future liability. For that, there are some limited mitigation opportunities we would be happy to discuss with you.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.