New HMRC statistics show the lifetime allowance continues to be a useful revenue earner for HM Treasury, but rumoured cuts at the next Budget could be a concern for soon-to-be retirees.

In the March Budget, the Chancellor announced that he would be freezing the pension lifetime allowance (LTA) at its 2020/21 level of £1.0731 million until the end of 2025/26. The LTA started life at £1.5 million in 2006/07 and peaked at £1.8 million in 2010/11. Since then, it has been cut three times and regularly frozen. Had the LTA merely been increased in line with the CPI since 2006, it would by now be close to £2.1 million, nearly double its current level.

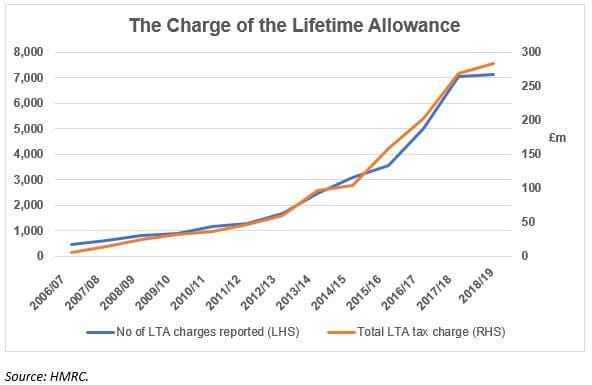

The reason why the LTA has been steadily devalued is to some extent explained by the graph above, which is based on revised and updated data recently issued by HMRC. This data shows that in 2018/19 over 7,000 LTA charges on pension scheme members were reported, with total tax payments of £283 million – an average of almost £40,000 per head.

The LTA benefits the Treasury in another, more subtle way. It presents a stark disincentive to make pension contributions for anyone with retirement funds that could reach – or have already reached – the LTA. This is especially true if you have any of the various LTA transitional protections that have been introduced over the years. The rules for some types of protection are such that any fresh contribution revokes the protection. For example, if you have Fixed Protection 2012, £1 of pension contribution would mean you lose a protected LTA of £1.8 million, potentially leading to a six-figure tax bill when benefits are drawn.

In practice, it may not be possible to avoid an LTA charge. Some employers will not offer a salary alternative to a pension contribution and, in those circumstances, suffering the maximum 55% LTA charge is better than foregoing 100%. Higher than projected investment performance can also land you with an LTA charge.

There have been renewed rumours that Chancellor Rishi Sunak will cut the LTA in the next Budget, with threshold figures between £800,000 and £900,000 popular guesstimates. If that or any other aspect of the LTA concerns you, do seek professional advice on your options before taking action. The LTA is only one of many tax traps surrounding pensions.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The value of tax reliefs depends on your individual circumstances.

Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.