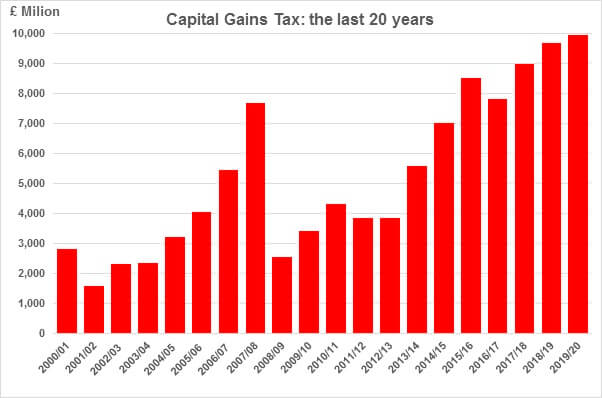

New HMRC data shows that in 2019/20, £9.9 billion of capital gains tax (CGT) liabilities were created.

In July last year, the Chancellor unexpectedly asked the Office of Tax Simplification (OTS) to review “capital gains tax (CGT) and aspects of the taxation of chargeable gains in relation to individuals and smaller businesses”. The top tax rate currently sits at 28% (limited to residential property and carried interest) with 20% liability more generally.

At the time, there was speculation that Rishi Sunak was looking at CGT as a way of raising extra revenue without breaking the Conservatives’ 2019 manifesto pledge not to increase rates for income tax, VAT and National Insurance. With those receipts of nearly £10 billion, it’s certainly a tempting target.

The OTS produced its first report on simplifying the design of the tax last November, prompting the rumour mill to forecast that CGT changes would appear in the Spring Budget. However, CGT barely received a mention in March beyond the freezing of the annual exemption for five tax years at the 2020/21 level of £12,300. In May 2021, the OTS issued a second report examining “practical, technical and administrative issues” of CGT.

The focus for CGT announcements now is on the next Budget. In theory, it is due in autumn, but in practice, it could once again be delayed until spring. By then, the economic landscape should be clearer as pandemic support measures cease and we weather another winter of Covid-19.

New data released by HMRC in August shows why the Chancellor may be tempted to follow the OTS advice to:

- Reduce the annual exemption to “a true de minimis level … in the range between £2,000 and £4,000”; and

- More closely align CGT rates with income tax rates. The OTS reckons this could theoretically raise an extra £14 billion, although it accepted “behavioural effects” would significantly reduce this figure in practice.

If you have unrealised capital gains, it could be wise to review them before the next Budget. One option could be to ‘bed and ISA’ – selling existing investments and then reinvesting them in an ISA to shelter any future gains from CGT.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

The value of your investment and income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.