A Taper Sulk not a Taper Tantrum

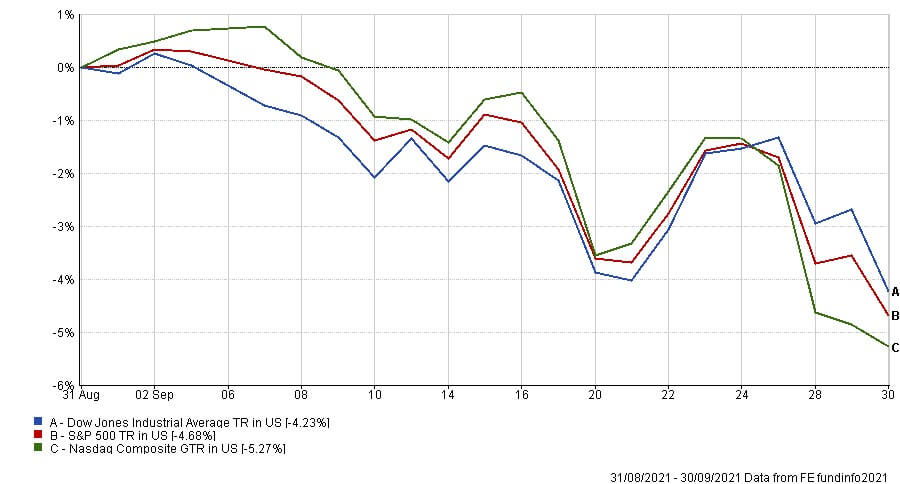

Apparently one of the historical realities of the US stockmarket is that typically it performs poorest during the month of September… certainly maintaining that undesirable record this year then. On average, September is the month when the US’s three leading indices – Dow Jones Industrial Average, S&P 500, Nasdaq – usually perform the poorest. An annual drop-off that has been coined the ‘September Effect’.

The US Big Three – September performance (local currency)

(Source: Financial Express Analytics. Past performance is no indicator of future returns)

(Source: Financial Express Analytics. Past performance is no indicator of future returns)

Inflation, asset tapering and interest rates

Of course, such is the importance and influence of the US stockmarkets, this weakness and volatility has rippled across global stockmarkets too. So what’s driving investor concerns this month. Well, it is basically three things:

- Is higher inflation proving more permanent than at first thought?

- When will Central Banks start withdrawing support by asset tapering?

- Is this the trigger for Central Banks to raise interest rates sooner than later?

The answer to the first question is still in the balance. Clearly disrupted supply chains, fuel crises and employee wage strength are inflation building, as shown in higher than expected inflation numbers – but are these factors still temporary and will they eventually wash through? The answer to the other two questions is that, bar any further systemic shock, these are going to happen. It’s just a matter of when.

The US Federal Reserve, The Bank of England, The European Central Bank are all trying to provide as much forward guidance to markets with regards monetary policy. Unfortunately, after some seismic monetary stimulus post-pandemic market sell-off, monetary policy is now going to tighten and the narrative about when that is going to happen is being brought forwards.

The Fed’s changing narrative

If we look at what the world’s most influential Central Bank has been telling us this year, you can see the narrative keeps changing at every meeting.

|

January 26-27 and March 16-17 meetings |

The inflation spike was anticipated, it is temporary due to coming out of lockdown and the base effect, Fed will not be raising rates until 2024. |

|

April 27-28 meeting |

Inflation continues to overshoot but wholly expected and remains transitory, unemployment keeps falling and the narrative subtly changes to ‘thinking about thinking about tapering’ asset purchases. |

|

June 15-16 meeting |

Asset purchase programme still in place but projection for first post-pandemic interest rate rises bought forward to late 2023. |

|

July 27-28 meeting |

Inflation still above target but only transitory, unemployment keeps falling, economy has opened up and the narrative changes to ‘talking about talking about’ asset tapering. |

|

September 21-22 meeting |

Many thought that this meeting would be the first announcement that asset tapering would start but the Fed maintained the asset purchase programme. However, the narrative about interest rates changed once more and the projection for rate rises was brought forward to late 2022. |

|

Upcoming November 2-3 meeting |

This is widely expected to be the meeting when asset tapering is announced. Of course, the devil is in the detail in that if it is announced, by how much will the asset purchases be tapered and when will it start. |

One can see the forward guidance the Fed keep giving the markets and that the day of monetary tightening by the Fed is coming ever closer. This is currently spooking markets once again, hence why we have seen government bond yields widen as their prices fall and equity markets start stuttering as investors look to reduce risk in the short-term.

A return to Q1 conditions?

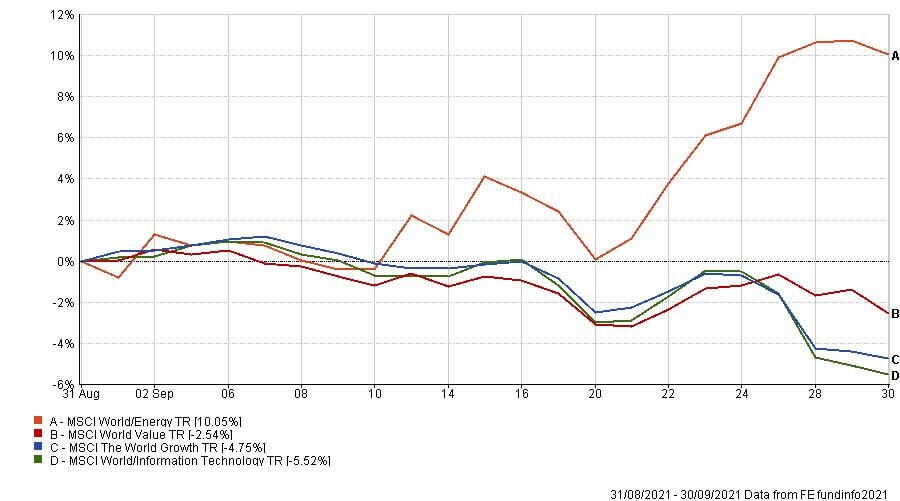

Not quite. Yes, inflationary pressures appear to be building again as mentioned and some cyclical sectors are outperforming lockdown winners again, as we can see from comparing the Global Energy sector against the Global Information Technology sector over September in the chart below. A comparison that we drew earlier in the year during the value, cyclical rally.

However, this does not necessarily mean that Value stocks are performing well overall. They currently are vs. Growth stocks as we can also see in the chart below, but only really in the last few days. And Value stocks have still lost money over the month too, just that in the very near-term they have held up better.

MSCI World Energy vs. MSCI World Information Technology and MSCI World Value Index vs. MSCI World Growth Index – September (local currency)

(Source: Financial Express Analytics. Past performance is no indicator of future returns)

(Source: Financial Express Analytics. Past performance is no indicator of future returns)

Don’t panic but keep listening

Markets are currently wrestling with Central Bank monetary policy, trying to second guess when and how they are going to tighten policy going forwards. The tapering of asset purchase programmes is arguably priced into markets now so investors are now worrying about interest rates – when will they be raised, by how much and how frequently.

Naturally, this is causing volatility within risk assets but it is the ‘risk-free’ assets – US Treasuries, UK Gilts, German Bunds etc. – that are suffering the most as they are highly interest rate sensitive.

However, even when interest rate rises are eventually announced – which we still don’t anticipate for some time I might add – cash deposit rates are still going to be very meagre indeed and nowhere near inflation levels. This means that investors must still invest in risk assets in order to achieve the potential for inflation beating returns, if appropriate to their circumstances. So even though September is shaping up to be a month to forget, we believe that this is not the start of a drawn-out bear market.

The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.