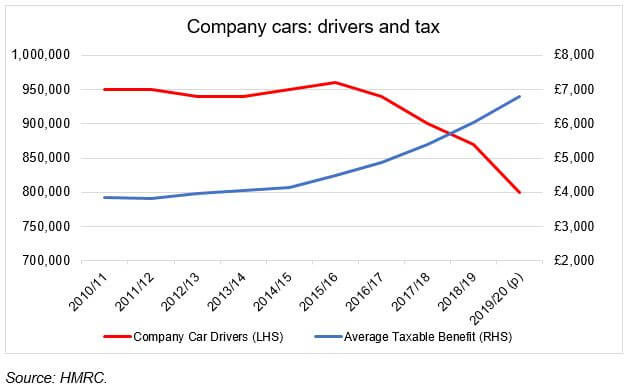

Recent data suggests the number of company car drivers continues to fall.

Once upon a time, the aspiration of many an office worker was to climb the ladder to the height at which a company car became part of the remuneration package. The appeal of being liberated from the expenses of motoring – sometimes including ‘free’ fuel – was considerable.

As the graph shows, the latest data from HMRC suggests that the lure of the company car is fading. However, HMRC is uncertain about the accuracy of the data because a 2016 administrative change means that, in HMRC’s view, “it appears there is still considerable underreporting” of company car ownership.

One factor that is not in doubt is that the tax on company cars has outpaced inflation. Between 2010/11 and 2019/20, the average taxable value of a company car rose by 76.1%, whereas consumer price index (CPI) inflation from April 2010 to April 2020 totalled 21.6%. The average taxable value of ‘free’ fuel has not risen as much, but the popularity of the perk has declined much faster than the company car’s. In 2019/20, only about one in nine company car drivers also had ‘free’ fuel, probably because for most drivers it was cheaper to buy their own fuel than pay tax on a notional benefit averaging £5,250.

The HMRC data only runs to 2019/20 – and figures for that year are provisional. The picture in 2020/21 onwards could be different as there was a significant reduction in the tax on zero-emission cars – almost all electric vehicles – from 15% of value in 2019/20 to 0% in 2020/21. That rose to 1% for the current tax year and will rise again to 2% from April 2022, a level at which it will remain until April 2025. Anecdotally, the cut has prompted renewed interest in electric company cars and schemes that allow employees to sacrifice salary for a car.

If you have a company car, think carefully when it comes up for replacement. Choosing a 100% electric or plug-in hybrid car could save you tax next time around, but you might be better off side-stepping cars altogether and asking your employer to increase their pension contributions.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.