Latest HMRC figures show that the annual allowance continues to help fill its depleted coffers.

The annual allowance is an important number in the pension world. It sets the maximum tax-efficient amount of total contributions in a tax year – from any source – that can be made to pension schemes for your benefit. If the allowance is exceeded, then you will be subject to an income tax charge on the excess which, for some people, can be the same as saying that some or all of your personal tax relief on the excess is effectively clawed back. However, the tax status of the benefits bought with the unrelieved contributions remains unchanged, meaning potentially that 75% is taxable when withdrawn.

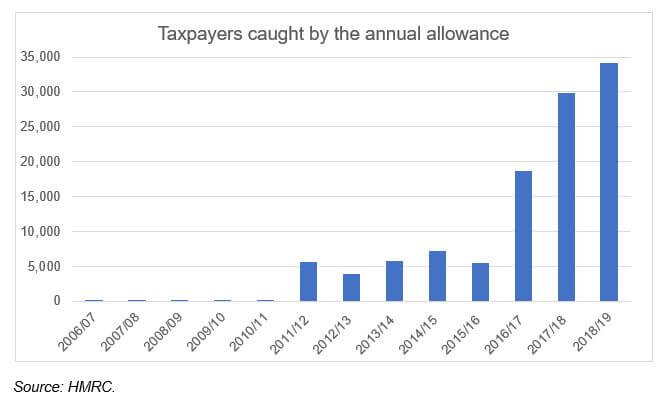

Until 2011, the annual allowance was set at a level that made it a somewhat academic topic – in 2010/11 it stood at £255,000. Then, in 2011/12, it was reduced to £50,000 – a cut of about 80%. The Chancellor’s aim was to lower the cost of tax relief at a time when the top rate of income tax was 50%. Three years later, from 2014/15, there was another reduction, this time to £40,000. In 2016/17 the axe fell for a third time, but on this occasion, it was more a salami-slicing than a chop. The main allowance remained at £40,000, but it became subject to a taper that could bring it down to as little as £10,000 for high-income earners.

The effects of these changes are visible in the graph. In 2010/11, only 140 people reported a liability for the annual allowance charge on their tax returns. That jumped to 5,570 the following year and 18,870 in 2016/17. At last count – three tax years ago – over 34,000 people were caught with total excess contributions of £817 million. The vast bulk of that excess would have been taxed at 40% or 45%, netting perhaps £350 million for the Treasury.

The Chancellor was forced to relax the rules for tapering in the 2020 Budget because potential tax bills were prompting NHS consultants and other senior public sector staff to take early retirement or limit their working hours. While the change should have reduced those paying the annual allowance charge in 2020/21, the problems it causes have not disappeared. That means you should always take advice on contribution levels, particularly if you are lucky enough to still be a member of a final salary pension scheme.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.