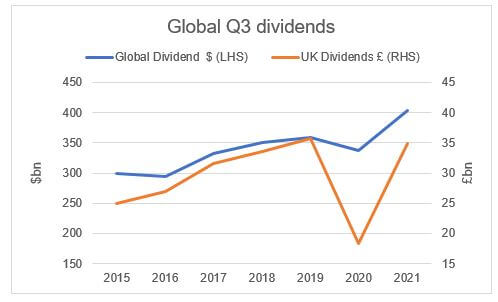

Research shows that in Q3 2021, dividend payments increased sharply in all major markets and are expected to return to pre-pandemic levels before the year’s end.

Sources: Janus Henderson, Link Group.

In 2020, global dividends fell by 11.9% year-on-year in USD terms according to an index calculated by the investment manager Janus Henderson. In the UK, dividends suffered a much greater drop, with a decline of 42.9% recorded by Link Group, a leading corporate services provider. The UK’s significant underperformance had much to do with the Bank of England forcing UK banks to suspend dividend payments.

Both Janus Henderson and Link Group recently published their latest dividend reports covering the third quarter of 2021. The gloom that pervaded 2020 had disappeared:

- On a global basis, overall dividend payments jumped a record 22.0% year-on-year to an all-time high for the third quarter of the year.

- In the UK, total dividend payments were 89.2% higher than in the same period of 2020.

Both sets of figures were helped by a boom in dividends from mining companies, which accounted for two thirds of the increase in global dividends according to Janus Henderson’s calculations. The biggest global dividend payer in the third quarter – and likely for the whole of 2021 – is BHP, an Australian miner whose shares are currently listed in both London and Sydney.

In the UK, miners took the top three positions in the dividend payers’ league for Q3 2021. Five mining companies paid special (one-off) dividends totalling £4.3 billion, about £1 in £8 of all dividend payments over the quarter. The result was that the concentration of dividend payments among a small number of companies in the UK grew significantly – just five companies (including that trio of miners) accounted for over half of Q3 dividends.

On a global basis, Janus Henderson expects dividends to surpass their pre-pandemic peak by the end of the year, a rapid recovery from their low point in March. While Link Group estimate that 2021 UK dividends will be 45% higher than 2020’s, that would still be 17.4% below the level of 2019.

If you are looking for income, these latest sets of dividend data are a reminder of the power of companies to generate income for their investors.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.