In theory, high inflation should mean high interest rates for student loans. But it is not that simple.

The Retail Prices Index (RPI) is no longer used as a National Statistic, but the government still finds uses for the index when the results work in its favour (because it is usually higher than the Consumer Price Index (CPI)). One good example is that the RPI forms the basis for calculating interest on student loans throughout the UK. The starting point for interest rates for each academic year is the annual RPI in March of the previous academic year. For the coming 2022/23 academic year, the RPI reading that matters the most is the one for March 2022.

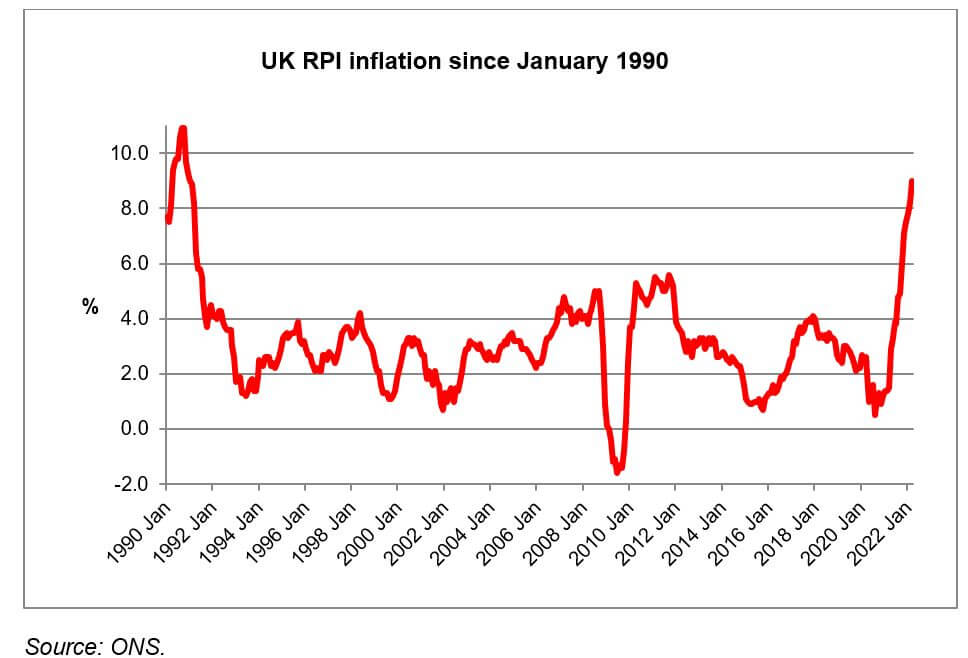

The bad news is that, as the graph shows, the RPI was at its highest level for over 30 years – 9.0% (compared with CPI of 7.0%). Cue headlines that some students would be paying 12% interest on their student loans, because many loans are subject to RPI plus a variable amount of up to 3%.

The good news is that the 12% headline is an example of overstatement by oversimplification. The student loan regimes differ throughout the UK and although each start with the RPI as a base figure, all apply some market-related cap to the interest charged. For example, the Plan 2 loans of students (and graduates) in England and Wales who started their course since 2012 have their interest capped at a level derived from Bank of England commercial lending data.

Until recently, that cap has been largely irrelevant because inflation has been so low. In 2022/23, it will become a significant factor. However, the story does not quite end there. The way in which student loans are administered means there is an effective six-month lag between the market cap being triggered and its coming into operation, and a corresponding delay before the benefit of the cap is withdrawn.

If you are now thinking you need a mathematics degree to understand what is going on, you are not alone. The upshot is that when it comes to student finance, as in many other areas of personal finance, expert advice is essential.

The value of tax reliefs depends on your individual circumstances. Tax laws can change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.