The high marginal tax rates created by phasing out the personal allowance are back in the news.

‘A million to pay 60% income tax within years,’ ran a recent headline in The Sunday Telegraph. The next day The Times picked up on the same story with the article ‘Inflation may leave million more workers paying 60% tax’.

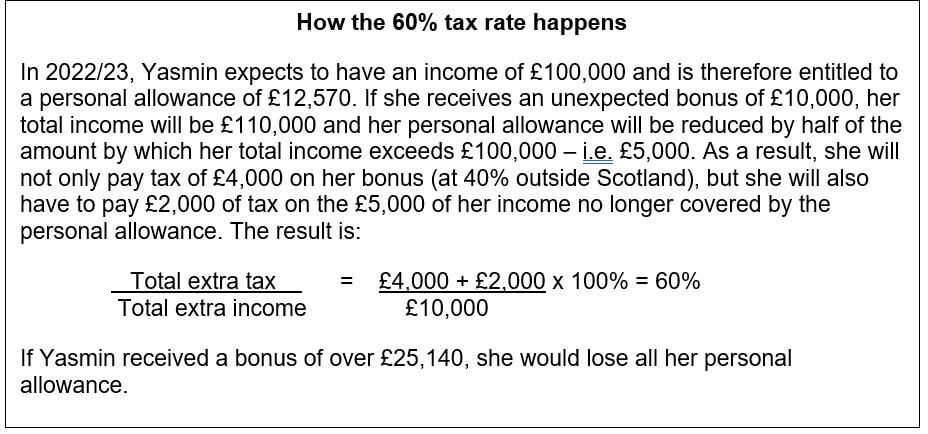

Whether either article counts as ‘news’ is debatable. The 60% income tax rate (or 61.5% on earnings in Scotland) has been around, in one form or another, since 2010/11. It is not, as The Times suggested, the result of ‘a glitch in the personal allowance regime’ but was the product of a carefully crafted piece of legislation. At the time, the aim was to raise extra revenue while keeping the threshold for the newly introduced 50% additional rate tax at £150,000.

The newspaper articles indirectly highlighted:

- The £100,000 threshold at which the personal allowance is tapered has been unchanged since 2010; and

- The personal allowance has almost doubled since 2010, resulting in a £25,140 band of income in which the 60% rate can bite.

Both factors mean that more taxpayers are being caught as incomes rise over time.

The one piece of good news is that if you are hit by 60% income tax you may also be able to claim 60% tax relief on pension contributions or gift aid.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.