Recent research has compared the value of personal national insurance contributions (NICs) with the value of state pension received. The results may surprise you.

NICs are not well understood, a fact exploited by Chancellors past and present. Many people mistakenly believe that NICs accumulate in a government fund to pay future benefits, in a similar way to how the traditional pension scheme operates. This is not the case. In practice, NICs are just another form of tax on earned income and one that successive governments have found easier to increase than income tax itself.

Up until recently, the government has allowed people to fill historic gaps in their NIC record up to six years after the year in question, but on 6 April, this will come to an end.

An individual’s NIC record determines how much state pension they will receive. The question of whether NICs provide value for money in terms of the pension benefits is thus a valid one and has attracted the attention of the number crunchers at the Pension Policy Institute (PPI).

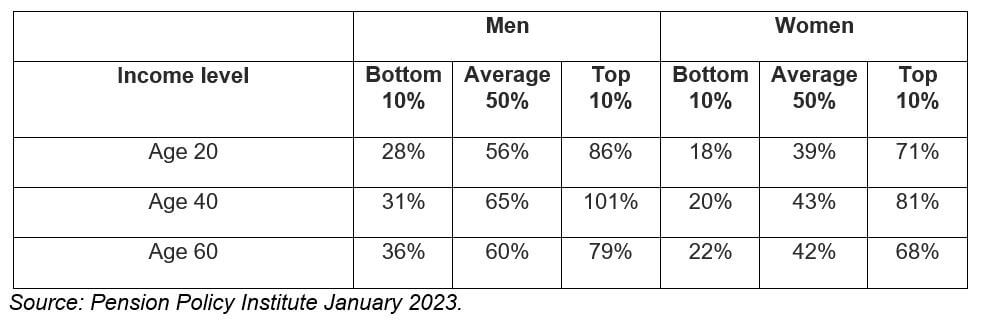

The PPI modelled the employee NICs payable and pension outcomes for men and women at current ages of 20, 40 and 60 with earnings in the bottom 10%, middle and top 10% of earnings.

Interestingly, the PPI assumed that while the middle earners would have a life expectancy that matched the principal projection from the Office for National Statistics (ONS), the low earners would live three years less and the high earners three years longer. That six-year socio-economic gap has been noted by the ONS in the past and is a reminder of the differences that are hidden with population-wide life expectancy figures.

The PPI produced a series of tables showing what proportion of each individual’s state pension was funded by their NICs (excluding employer’s contributions), meaning anything less than 100% implied more coming out in pension than what went in as NICs. The results are summarised below.

As shown in the table, women do better than men due to living longer, while the lower paid win over the higher paid because under the new state pension regime that has operated since 2016, pension accrual is at a flat rate, regardless of earnings.

Now is a good time to check your own NIC record as the opportunity to pick up missed payments beyond six years ago will disappear from 6 April.

The Financial Conduct Authority does not regulate tax advice.

Tax treatment varies according to individual circumstances and is subject to change.

Content is correct at the time of writing and is intended for general information only and should not be construed as advice