New research shows that global dividends have shaken off the impacts of Covid-19 and reverted to their pre-pandemic days, but the UK’s performance isn’t so promising.

When the Covid-19 pandemic hit in 2020, it had contrasting impacts on the values of shares and the dividends they paid. While share prices dropped precipitously in the first few months of the year, they regained most of their losses by summer and, on a global basis, ended the year higher than where they started.

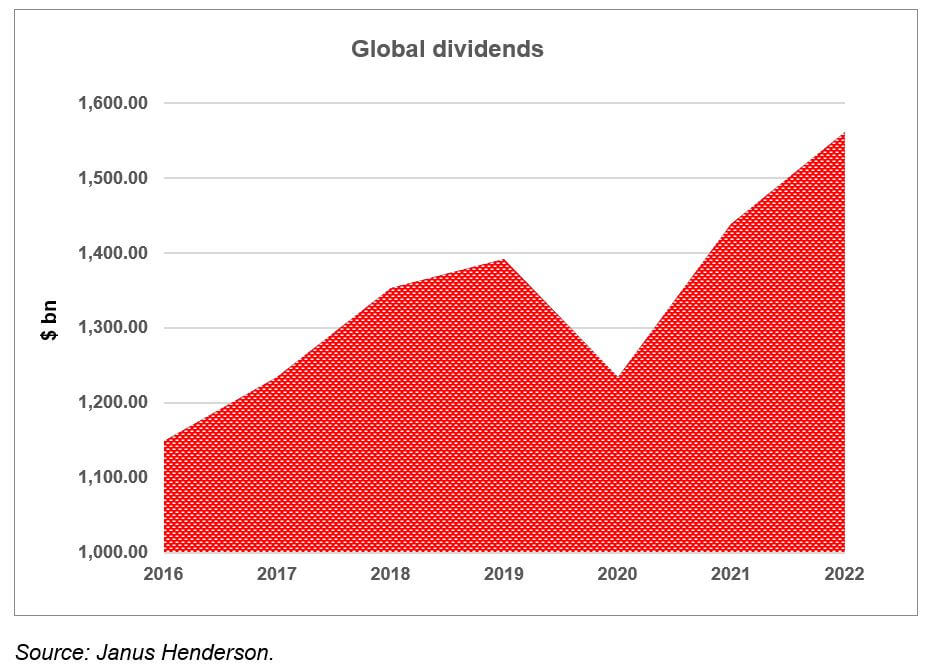

In contrast, global dividend payments across 2020 were down 11.3% on 2019 in dollar terms according to the investment group Janus Henderson. In 2021, total dividends rose by 16.3%, but that still left them only 3.4% above their 2019 levels. Much of that recovery was due to US companies – 2021 total dividend pay outs in Europe, Japan and the UK were all below 2019 levels.

Janus Henderson recently published its global dividend data for 2022. This showed overall dividend growth (again in dollar terms) was +8.4%. In local currency terms, all of the world’s main investment regions recorded positive dividend growth. However, outside North America, the regional performances shrunk when converted into the mighty US dollar. For example, Japan’s 16.3% Yen-based dividend growth was negative in US dollar terms.

As the graph shows, taking a longer-term view, global dividends are now back on the trendline established before the pandemic. The UK, however, is a laggard over the same 2016–2022 timescale. In dollar terms, UK dividend payments are nearly 6% down, whereas the global figure is up almost 36%. Some of the UK’s relative poor performance is down to the weakness of sterling, which started 2016 at $1.4245 but by the beginning of 2023 stood at only $1.2308.

Another contributing factor has been companies leaving the London Stock Exchange, either because of a takeover (such as the supermarket, Morrisons) or because they choose to list elsewhere (for example, the mining group, BHP).

If you want income-generating share-based funds, the global dividend recovery is a reminder that you should not confine yourself to the UK equity market.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The contents of this article are for information purposes only and do not constitute individual advice.