Figures released alongside the Budget have highlighted a projected surge in the number of people who will pay more than the basic rate of tax.

Both the Budget and the Autumn Statement are usually accompanied by a weighty document called the Economic and Fiscal Outlook (EFO). The EFO is the work of the Office for Budget Responsibility (OBR), the body charged with producing an independent assessment of the government’s tax and spending plans. The EFO that emerged in March 2023 ran to 172 pages, so it may not have been entirely digested in most coverage of the Budget.

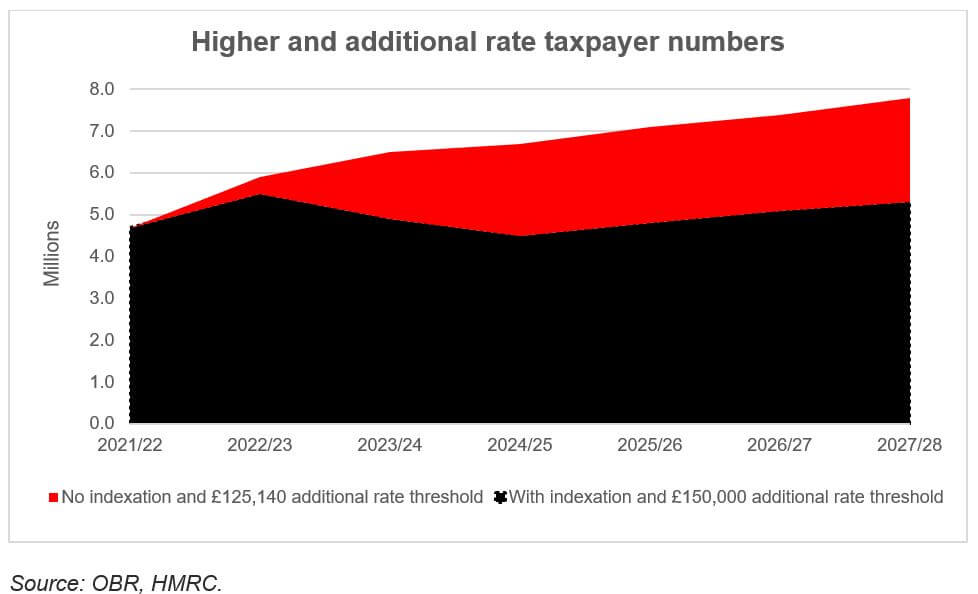

However, the OBR’s number crunching can yield some interesting information, not always to the government’s liking. The graph above is an excellent example. What it shows is the impact of three key changes to the income tax rules in the past two years:

- Prime Minister Rishi Sunak’s announcement in March 2021 as former Chancellor that the higher rate tax threshold would be frozen at its 2021/22 level of £50,270 for the following four tax years (to 2025/26);

- The subsequent extension of that freeze for another two tax years by Chancellor Jeremy Hunt in last year’s Autumn Statement; and

- Mr Hunt’s reduction in the additional rate threshold to £125,140 from 2023/24 (followed by Scotland doing the same for its top rate).

The black area on the graph shows the OBR’s projected number of higher and additional rate taxpayers that there would have been if the higher rate threshold had been inflation-linked after 2021/22, and the additional/top rate threshold held at £150,000 (where it started life in 2010/11). The red area sitting atop the black shows the increase in taxpayer numbers that occurs because of the six years of higher rate threshold freeze combined with the additional rate threshold cut.

The jump in the first half of the period is down to high inflation, which was not anticipated by the OBR (or anyone else) back in 2021. As the OBR projects less than 0.5% a year average inflation in the three years from 2024/25, the two blocks run roughly parallel in the second half.

By 2026/27, the OBR calculates that there will be 2.1 million more higher rate taxpayers and 0.4 million extra additional rate taxpayers because of the three measures. That means about one in five of all income taxpayers will be paying more than basic rate tax.

As the new tax year gets underway, what better reason to start your tax planning.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

The contents of this article are for information purposes only and do not constitute individual advice.