The Bank of England has been looking at the impact of its regular interest rate increases since December 2021, with analysis revealing savers are being short-changed.

Every three months the Bank of England issues a weighty Monetary Policy Report. In it the Bank sets out the economic analysis and inflation projections that its Monetary Policy Committee uses to make their interest rate decisions. While that might sound like a cure for insomnia, it often includes some valuable insights into the Bank’s thinking and how UK plc is functioning.

The May report was released on the day that the Bank of England announced its twelfth consecutive increase in Bank Rate, to 4.5% (there has been another 0.50% added since). It seems hard to believe it now, but the Bank Rate’s starting point was a mere 0.1%, the level that was introduced just as the Covid-19 pandemic began. Perhaps because the Bank has travelled so far, the report examined how the rate rises had worked through the economy.

It found that “staff analysis suggests that changes in risk-free rates have passed through as expected into new mortgage and corporate borrowing rates… but pass-through into household instant-access deposit rates has been muted.”

Translated from bank-speak, that means the Bank’s experts – like many a layperson – had decided that interest charged to borrowers was keeping pace with the Bank’s rate increases, but the returns to depositors were not. The Bank’s researchers found that the average instant access account rate had risen by 1.42% (to 1.53%) between November 2021 and early May 2023, whereas the Bank Rate had increased by 4.15%.

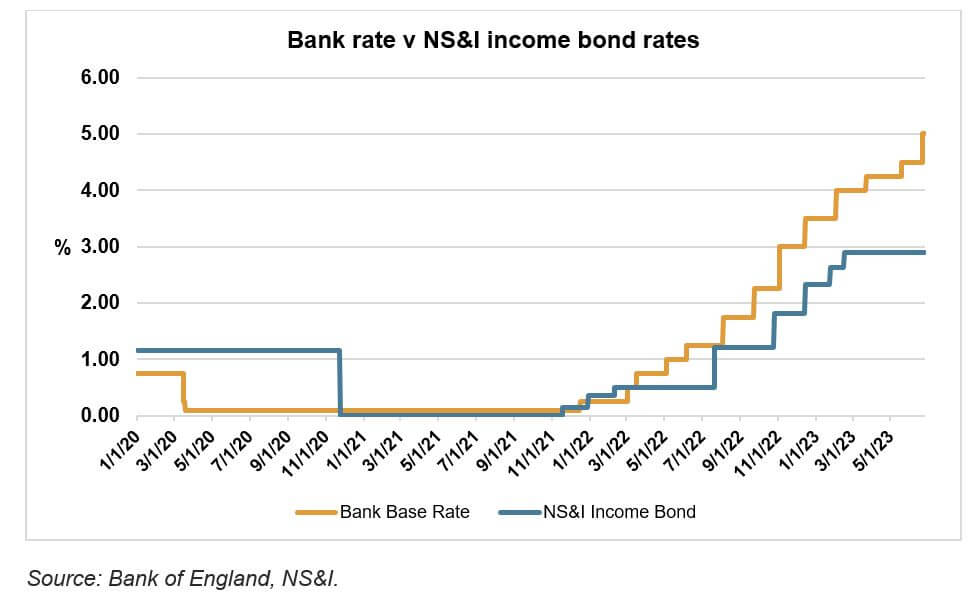

The Bank’s comments about short-changed savers have been echoed by the Treasury Select Committee, which has been asking “…why savings rates are much lower than the current interest rate, how the banks and building societies determine the level of interest rate increases to pass on to savers, and whether they inform their loyal customers that higher alternatives may be available.” As the graph shows, the government itself – in the guise of National Savings & Investments – has also been less than generous.

For their part, the major banks have every incentive not to pass on Bank Rate increases in full to savers, as widening their interest margin is an easy way to raise profits. For savers, the message is to:

- make sure you know what your cash is currently earning;

- move it if you are not happy – you should be earning close to 4%; and

- be wary of holding too much on deposit, as no available interest rate comes near matching current inflation.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.