New income tax statistics from HMRC appear to be good news, but the numbers are not what they seem.

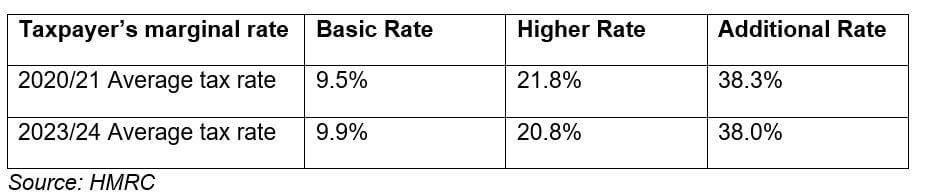

This table, recently released by HMRC, shows the average income tax rate for the three main categories of taxpayer. For example, in 2020/21, on average, basic rate taxpayers paid 9.5% of their income in tax and in the current tax year are expected to pay a slightly larger share, 9.9%. At first sight, higher rate and additional rate taxpayers seem to be doing better, as their average income tax rate drops.

HMRC offers no real explanation for the difference, other than a statement that says, “Average rates of income tax vary over time depending on the number of overall income tax payers and the number in each marginal rate band, as well as growth in incomes and changes to income tax thresholds and allowances.”

The story behind the changing numbers may be why HMRC is less than comprehensive in setting out what has happened:

- For basic rate taxpayers, the average rate has increased because the personal allowance has only risen by £70 (0.56%) since 2020/21, whereas average weekly earnings increased by 23% between April 2020 and April 2023. So a greater share of income is taxable in 2023/24 than in 2020/21 and the proportionate tax rate rises.

- The backdrop for higher rate taxpayers is the same, so why the falling average rate? What HMRC forgot to mention is that in 2020/21, the higher rate tax band ended at £150,000, whereas in 2023/24 it stops at £125,140. Many higher rate taxpayers towards the top of the band three years ago have now migrated into the additional rate band. The overall result is the lower average rate for higher rate taxpayers.

- The picture for additional rate taxpayers is almost a mirror image of the higher rate scenario. The near £25,000 lower starting point for additional rate in 2023/24 than 2020/21 means there are just about double the number of additional rate taxpayers in 2023/24 than in 2020/21. That extra, lower income population in the additional rate band drags down the average rate.

All of which should make you check what tax band you fall into for 2023/24 and seek professional advice if you have questions or concerns about how the changing rates might affect you.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

For specialist tax advice, please refer to an accountant or tax specialist.