National Savings & Investments has launched two top of the savings league table one-year bonds, but the headline rates may not be your net return.

The primary role of National Savings & Investments (NS&I) is “cost-effective financing for the government.” In the current financial year, NS&I has been charged with raising between £4.5 billion and £10.5 billion for the Treasury coffers, a relatively modest sum compared with a projected £237.8 billion of government bond sales. However, NS&I saw net outflows in June and July totalling £0.3 billion according to the Bank of England.

In response to those outflows and the continued upward pressure on interest rates, in August NS&I went on the offensive and raised the returns on many of its offerings, from the Direct ISAs to the Green Savings Bond. The change that attracted most attention was the new rates for the one-year Guaranteed Growth Bond (GGB) and Guaranteed Income Bond (GIB).

Both of these one-year bonds now offer a 6.2% annual equivalent rate (6.03% payable monthly on the Guaranteed Income Bond). Their previous rates had been 5.0% and 5.12% AER. The 1%+ increases took both bonds to the top of the one-year league tables, where they remain at the time of writing. It is unusual to find an NS&I product sitting in a number one position in any savings league table, not least because it calls into question the product’s cost effectiveness. NS&I has traditionally relied upon its 100% Treasury guarantee to allow it to pay below the best the internet can offer.

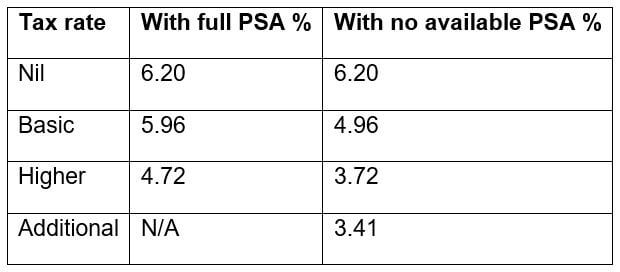

Arguably, 6.2% is a good rate, but unless you are a non-taxpayer (once the NS&I interest is added), you will need to factor in tax to assess your net return. This is complicated by the personal savings allowance (PSA), which is £1,000 for basic rate taxpayers, £500 for higher rate taxpayers and nil for the newly expanded band of additional rate taxpayers. Crunch the numbers on a £20,000 GGB and the net returns depend on how much unused allowance you have:

As is often the case, the lesson is to ignore the headline number and focus on the net figure. You could find a cash ISA with a lower headline rate that offers a better net return.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing.