The gap between two government set income levels is the widest it has ever been.

The National Living Wage (NLW) and the new State pension both started life in April 2016 during George Osborne’s tenure as Chancellor. In his March 2013 Budget, he announced that the new State pension would begin a year earlier than had originally been planned. Just over two years and an election later (and still Chancellor – they were different times), in July 2015, Mr Osborne produced another surprise in the form of the NLW.

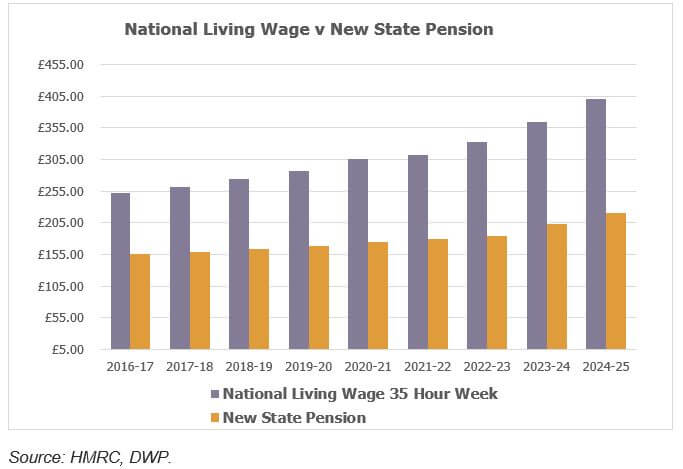

When the NLW began, it was pitched at the rate of £7.20 an hour, or £252.00 a week, based on a 35-hour week. The new State pension, back then often called the single tier pension to avoid confusion with its predecessors, was set at £155.65 a week. Following this November’s Autumn Statement, the NLW is set to rise to £11.44 an hour in April, equivalent to £400.40 for a 35-hour week. The new State pension will benefit from the Triple Lock and rise to £221.20 a week.

Viewed another way, over the eight years to April 2024:

- The NLW will have risen by 58.9%; and

- The new State pension will have risen by 42.1%.

As an approximation to inflation over the period, we can say that between September 2015 and September 2023, prices as measured by the CPI rose by 31.7%, so the NLW and new State pension have both outpaced the most widely used yardstick. Using the same timescale, average weekly earnings are up by 39.3%, so again the NLW and new State pension are ahead.

The gap in growth between the two is primarily down to the target that was given to the Low Pay Commission when setting the NLW. Since March 2020, the Commission has had to balance affordability with a goal of the NLW reaching two thirds of median earnings by 2024. That has necessitated a fast growth rate – hence the 9.8% NLW rise from April. From 2025 onwards, NLW increases should stay in line with overall earnings growth… for which many employers will be grateful.

Meanwhile, there is an interesting question that has not been addressed by the government: why is the new State pension level now only 55% of the NLW?

Content correct at the time of writing.