As the FTSE 100 turned 40 on 3 January 2024, we look at how it compared to its predecessor and the lessons learned from four decades of growth versus inflation.

The Financial Times Stock Exchange (FTSE) 100 Index, to use the Footsie’s full name, has celebrated its 40th anniversary. It is a significant milestone and an opportunity to take stock of the index’s history and position.

The UK’s benchmark stock market index was launched in 1984 by the London Stock Exchange, designed as a modern successor to the FT30 Ordinary Share Index produced by the Financial Times. The FT30 was a product of a pre-computer era and once calculated using a slide rule. There are other starker comparisons with the 100-share FTSE 100:

- The FT30 shares were hand-picked by an editorial team at the Financial Times. The index was prone to age poorly given its data was only changed if there was a merger or bankruptcy. In contrast, the FTSE100’s constituents are selected according to a detailed set of rules, largely driven by company size, and reviewed quarterly.

- Weighting played another key difference. To make life easy for the slide rule user, each company in the FT30 had an equal (3.33%) weighting in the index, regardless of its market size. In contrast, the more sophisticated FTSE100 weighted each share according to corporate value. That means that just five companies – Shell, AstraZeneca, HSBC, Unilever and BP – account for nearly one third of the index.

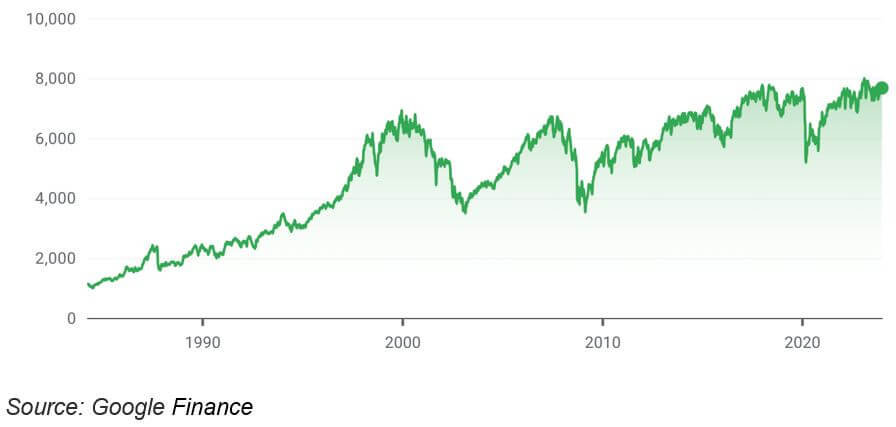

From its initial launch value of 1,000, the FTSE100 has climbed to 7,721.52 by its 41st year on 3 January 2024. That equates to an annual growth rate of 5.2%. Inflation over the same period, as measured by the Retail Prices Index (RPI – the CPI does not go back beyond 1988) averaged about 3.7% a year.

Like most indices, the FTSE100 measures only capital values and does not include dividends. When dividends are considered, the total return on the FTSE100 rises to 8.2%, an annual 4.5% outperformance of inflation. Dividends are still a key factor in the returns from the FTSE100 today, with the Index offering a dividend yield of close to 4%.

If there is one lesson from the FTSE100’s legacy of the past four decades, it is that next time you see or hear its performance being quoted, check whether dividends have been taken into account.

The value of your investments can go down as well as up, so you could get back less than you invested. Past performance is not a reliable indicator of future performance.

Content correct at time or writing.