Individual Savings Accounts will celebrate their 25th birthday on 6 April 2024.

A quarter of a century ago, Personal Equity Plans (PEPs) and Tax Exempt Special Savings Accounts (TESSAs), both inventions of Conservative chancellors, were replaced by Individual Savings Accounts (ISAs), introduced by a Labour chancellor. To a large extent, the exercise was a rebadging rather than the creation of a brand new savings plan. Nevertheless, the new name survived the swing back to a Conservative government in 2010.

Since then, a variety of chancellors have made tweaks to ISAs, broadening the investment remit, expanding the range of target savers and, somewhat randomly, raising the overall contribution limit (now £20,000 per tax year, as opposed to £7,000 originally). The more significant changes include the launch of the Junior ISA in November 2011 and the Lifetime ISA in April 2017.

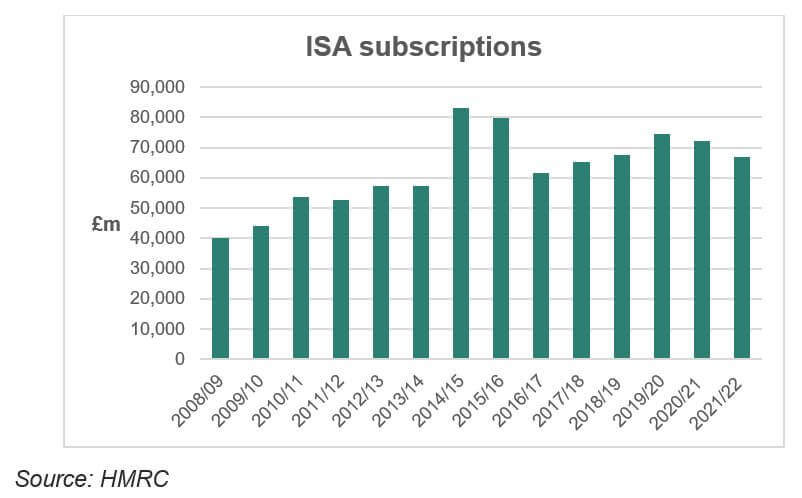

As the graph shows, the popularity of ISAs has waned in recent years. Some of the blame can be placed on the prolonged period of low interest rates until 2022. This was exacerbated by the introduction of the personal savings allowance (PSA) in 2017, which allows basic rate taxpayers to receive £1,000 a year interest tax-free (£500 for higher rate taxpayers, but nil for additional rate taxpayers). In the era of miniscule interest, it took a substantial deposit to generate enough income to exceed the PSA. Stocks and Shares ISAs suffered a similar fate from 2017 with the launch of the dividend allowance in 2017, initially set at £5,000.

As the traditional ISA season reaches its turn-of-tax-year peak, there are reasons to think that ISAs are overdue some revived attention:

- Higher interest rates have reduced the effectiveness of the PSA, still fixed at its 2017 level. There are also more additional rate taxpayers with no PSA, thanks to the cut in the threshold to £125,140 from 2023/24.

- The dividend allowance falls to just £500 from 2024/25.

- The annual capital gains exemption is also halving, to £3,000 in 2024/25.

Even if you do not currently need the income tax and capital gains tax (CGT) shelter provided by ISAs, you might do in the future as your wealth or income grows. ISA contribution limits are use-it-or-lose-it: unlike pensions, there are no carry forward provisions for ISAs across tax years. If you need inspiration, remember that some ISA savers who started on the regular subscription path 25 years ago now have over £1 million invested, all UK tax-free.

Content correct at time or writing.