April’s yearly inflation figure has fallen by 0.9% to 2.3%, so why does inflation still feel high?

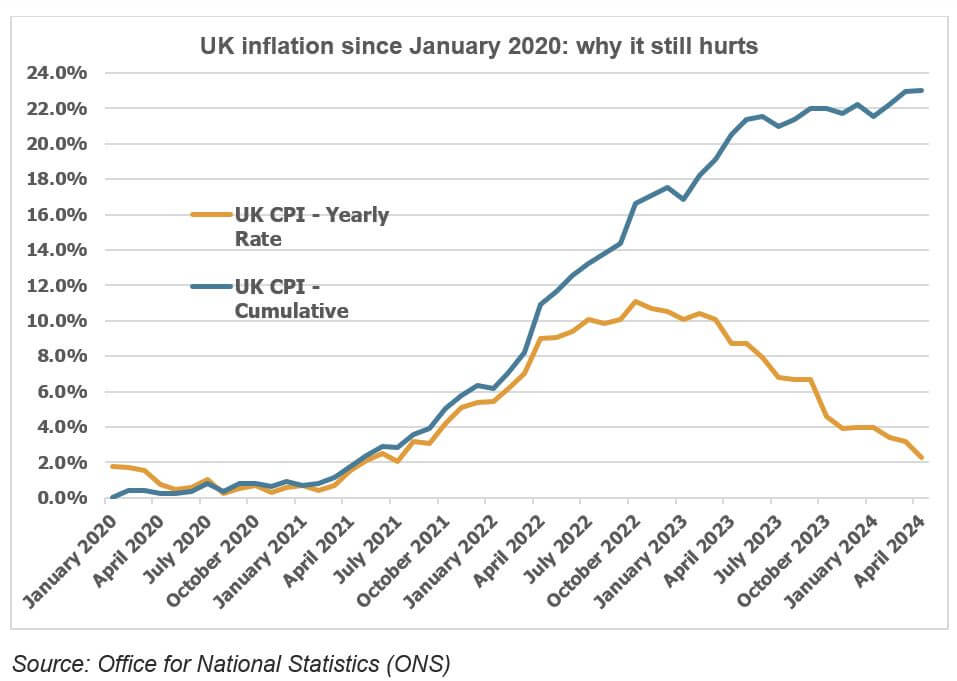

April’s Consumer Prices Index (CPI) showed annual inflation had fallen to 2.3%, its lowest level since July 2021 and significantly below the October 2022 peak of 11.1%. The Prime Minister, Rishi Sunak, celebrated the return to around 2% inflation with a press release saying, ‘Today marks a major moment for the economy, with inflation back to normal’. So why does inflation still feel like a problem for so many people?

There are many possible answers, including:

- Your perception of inflation may not be on the same timescale as annual inflation figures. We are more likely to compare today’s prices with those of two or three years ago rather than at the same time last year. That means thinking about cumulative inflation over 24–36 months, not 12 months. As the graph shows, a longer timescale makes a significant difference once inflation starts to fall.

- Inflation tends to be more obvious for items bought regularly, such as food. The latest annual food inflation reading is 2.8%, but last October it was overrunning at above 10%. Since the end of 2019, food prices have increased by 30%, 7% more than the overall CPI inflation.

- The basket of goods measured by the CPI probably does not match your expenditure. The Office for National Statistics (ONS) provides a tool that allows you to work out your personal inflation rate available on the government website.

- The CPI does not include costs for owner occupiers’ housing costs (OOH), although it does cover rental costs, utility bills, minor repairs and maintenance. The CPI including owner occupiers’ housing costs (CPIH) inflation measure, which incorporates OOH, was 3.0% in the year to April 2024, while the OOH component was 6.6%, its highest since July 1992 according to ONS calculations.

- The calculation of any inflation index is subject to various statistical quirks, one of which is base effects. These have become significant for the CPI because of Ofgem’s quarterly utility price cap. The cap fell by 12% between March 2024 and April 2024, whereas utility prices did not change in the same two months last year.

However you feel about the latest inflation figures, the onward march of prices is something that you should not ignore in any financial planning.

Content correct at the time of writing.