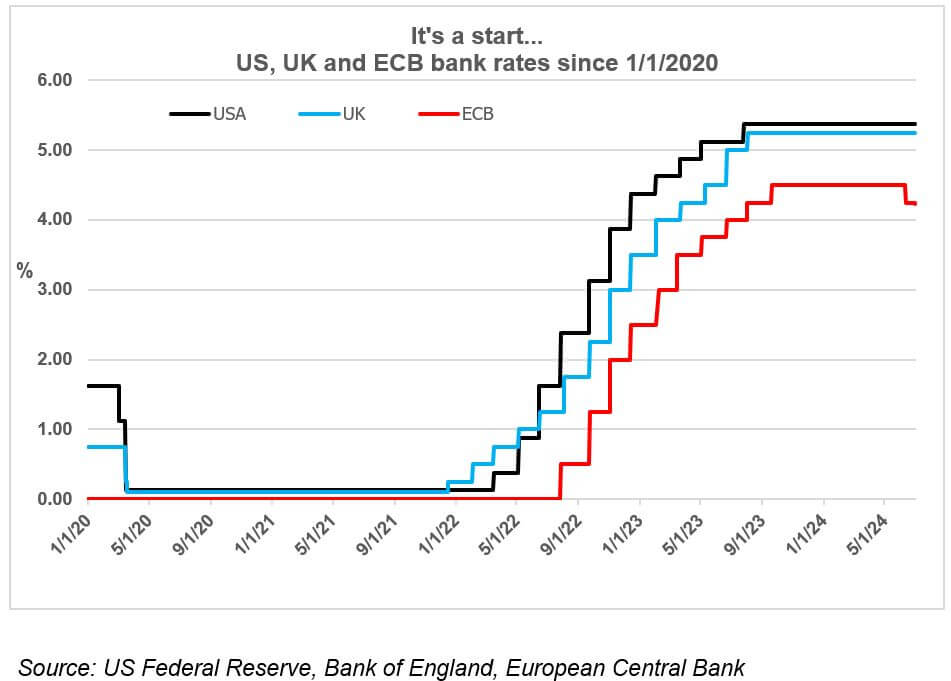

Central banks around the world are beginning to cut interest rates with the European Central Bank leading the way.

On 6 June 2024, the European Central Bank (ECB) became the first major central bank (the big three being the US, UK and European) to announce an interest rate cut in the current cycle. This marked the ECB’s first cut since September 2019, when its main rate was reduced to a negative rate of -0.5%. ECB President Christine Lagarde hinted at a June cut for some time, so the move came as no surprise. She has been more guarded about future reductions, which suggests June’s move does not herald the start of regular cuts at each meeting.

Two weeks after Lagarde’s cut, her counterpart at the US Federal Reserve (the Fed), Jerome Powell, also produced an unsurprising interest rate announcement: no change. At the same time, the Fed’s rate-setting committee released its quarterly projection of interest rate falls for the next two years – using forecasts from its members. The detail is summarised in what the investment community calls the ‘dot plot’ and suggests only one cut of 0.25% by December 2024, followed by another four in 2025.

Eight days later, the Bank of England, led by Andrew Bailey, repeated Powell’s no-change mantra. While the Bank denies its decisions are influenced by politics, like the Fed, it was understandably wary of making interest rate changes close to an election. The Bank also faces a problem that the Fed and ECB do not: average earnings growth of around 6%. In the view of most economists, and the Bank, a 6% rise in earnings is incompatible with 2% inflation – the Bank’s target. Even so, after the Bank’s decision in June, the money markets were pricing in a near-even chance of a cut at the beginning of August.

If you have been accumulating cash on deposits earning an interest rate usefully above inflation, now may be the time to consider investing that capital. The period of higher-for-longer interest rates may not last for much longer.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Content correct at the time of writing.