Q3 2024 Update

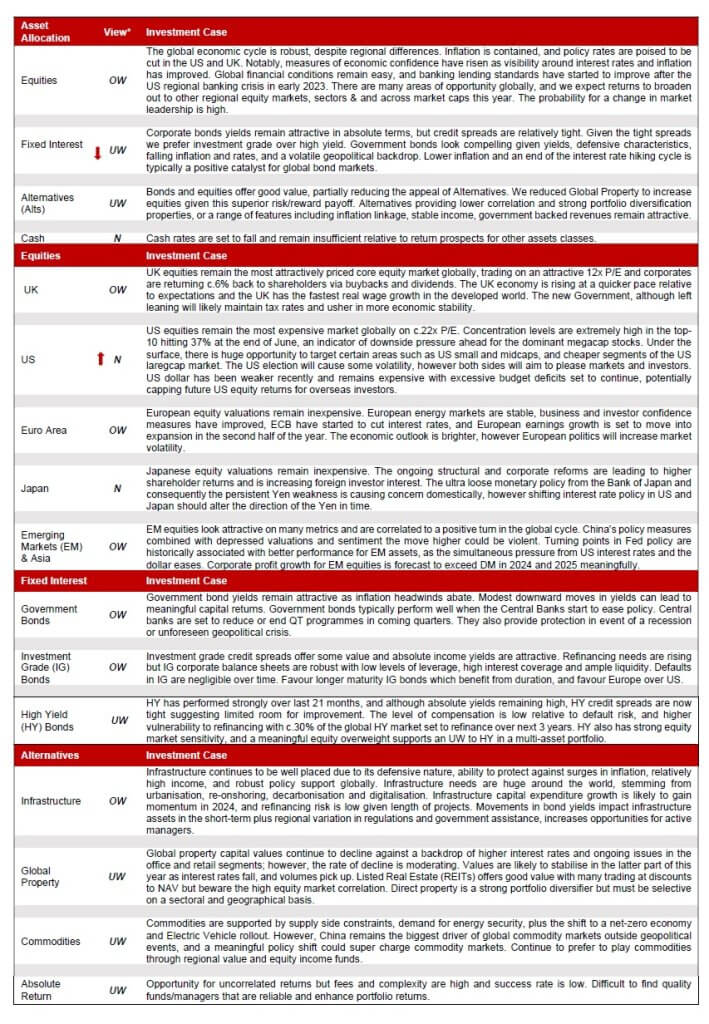

*Arrows denote change in view, up denotes upgrade from UW to N or N to OW, down denotes downgrade from OW to N or N to UW

- Overweight (OW) – favourable view of the asset class in the short-term and generally have a higher allocation relative to our long-term strategic allocation.

- Neutral (N) – balanced view of the asset class in the short-term and generally have a comparable allocation relative to our long-term strategic allocation.

- Underweight (UW) – less favourable view of the asset class in the short-term and generally have a lower allocation relative to our long-term strategic allocation.

Important information

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Information was obtained from proprietary and non-proprietary sources deemed reliable by Chase de Vere.

Where the qualified Investment Manager has expressed views and opinions, they are based on current market conditions and their professional judgement and are subject to change.

The information contained within this update is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

Prices were correct at the time of writing.