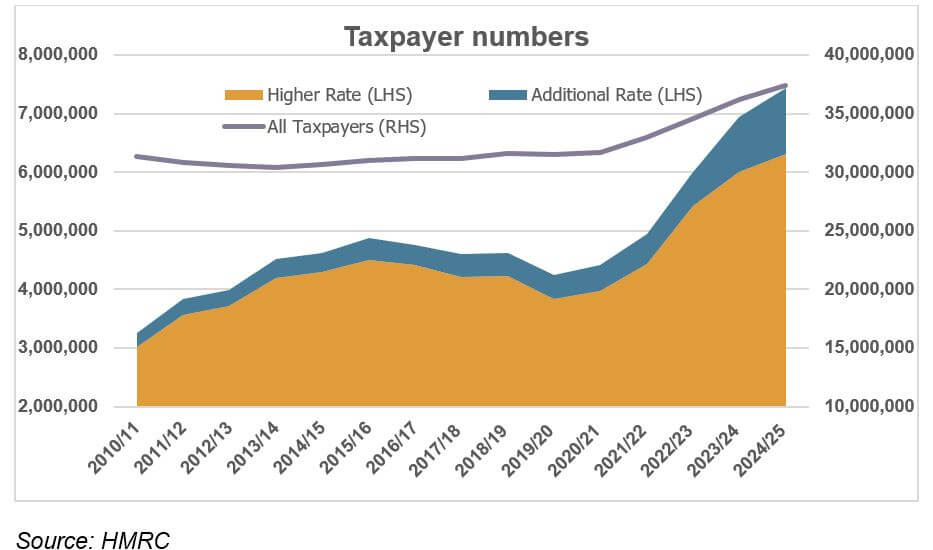

New data from HMRC show growing numbers of income taxpayers paying above the basic rate.

The club that all members want to leave, the income tax playing club, is gathering ever more members who are paying every greater subscriptions. That, at least, is one way of looking at some updated statistics which HMRC published in the final week before the election. Curiously, the main parties ignored the data, reinforcing what the independent Institute for Fiscal Studies described as an election-time “conspiracy of silence” on the true state of government finances.

The HMRC data, which included projections for the current tax year, showed:

- The taxpaying population has risen to 37.4 million in 2024/25, 6.2 million more than in 2019/20. That 20% increase is primarily the result of the freezing of the personal allowance (£12,570 since April 2021) and recent high inflation (21.3% between April 2021 and April 2024). The sharp rise in the taxpaying population could help explain some of the administrative problems HMRC have experienced.

- Higher rate taxpayer numbers are projected to be 6,310,000 in 2024/25, just over one in six of all taxpayers. As recently as 2010/11, that proportion was less than one in ten. The current tax year’s figure would have been even higher, but for the Scottish government’s decision to introduce a new tax rate, advanced rate at 45%, for 2024/25. HMRC has classified advanced rate taxpayers as additional rate taxpayers in their UK-wide statistics, even though their income would make them higher rate taxpayers outside Scotland. Without that change, the higher rate numbers would have been 114,000 greater, based on Scottish Budget estimates.

- Those Scottish advanced rate taxpayers also explain some of the 180,000 jumps in the additional rate taxpayer numbers for 2024/25 to 1,130,000 – 3% of all taxpayers. In 2010/11, when the additional rate was introduced (at 50% on income over £150,000), the corresponding proportion was just 0.75%. The threshold was cut to £125,140 from April 2023.

The precarious state of government finances means that the freezes on the personal allowance, and higher and additional rate thresholds are unlikely to disappear before at least April 2028. That provides a good reason for making sure that your investments are structured in the most tax-efficient ways available.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing.