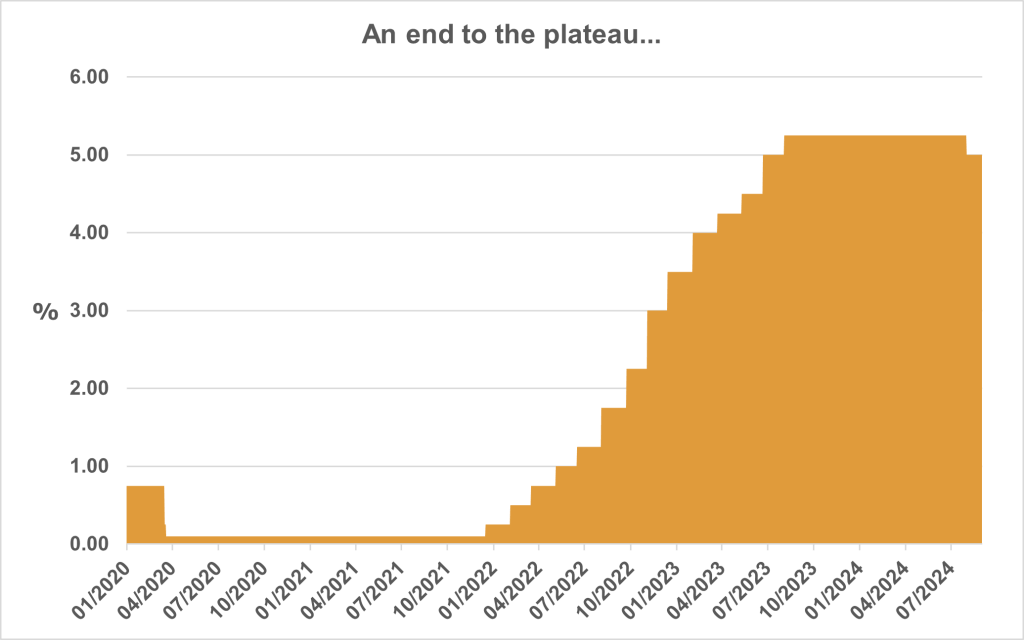

August saw the first cut in UK interest rates since March 2020.

Source: Bank of England

On 1 August, the Bank of England cut its bank rate by 0.25% to 5.00%, the first cut made since the early days of the Covid-19 pandemic in March 2020. The Bank’s Monetary Policy Committee, which made the decision, voted 5–4 in favour of the reduction. That underlines the division of opinions – the Bank’s Governor, Andrew Bailey backed the cut, but its Chief Economist, Huw Pill, took the opposite viewpoint.

The Bank of England was not the first of the central banks to cut rates – its European counterpart made a quarter-point reduction in June. On the other side of the Atlantic, the US Federal Reserve announced no rate change on the day before the Bank of England’s move, although it is expected to reveal a cut – perhaps 0.5% – after its mid-September meeting.

What the Bank of England does next on interest rates will depend on the data, to use a common central banker’s excuse. The Bank’s primary concern is inflation, which rose in July to 2.2% and is expected to go up further in the coming months. However, these increases are largely statistical quirks, related to falls in the utility price cap in 2023 which are not being repeated in 2024. The Bank’s central forecast currently sees inflation at 2.4% in a year’s time, then declining to 1.7% in the following year and 1.5% a year later.

Perhaps surprisingly, the Bank does not publish any of its own forecasts for short-term interest rates, but instead issues tables showing what the money markets are implicitly predicting. These show bank rates down to 3.5% in three years’ time.

The August cut is already being reflected in instant access savings rates. Fixed-term rates have been falling for some time, although National Savings and Investments recently increased rates on British Savings Bonds (they remain relatively uncompetitive). Annuity rates are also off their 2023 highs, but still attractive compared to most of the past 15 years. If you hold more cash than you need for a rainy day or want to lock in some or all of your retirement income, the time to act is now.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Content correct at the time of writing.