HMRC has updated its estimates for the cost of pension tax relief. Rachel Reeves will have taken note ahead of her first Budget on 30 October.

Source: HMRC

It was pure coincidence, but two days after the Chancellor had revealed a £22 billion black hole in government finances for the current financial year, HMRC released its annual update of the cost of pension tax reliefs. The headline figure (for 2022/23) was £48.7bn, more than twice the size of that black hole.

That huge multi-billion figure of pension relief is not as straightforward as it seems, a point often missed in media coverage. It is the sum of seven separate components:

| Source in 2022/23 | £ billion |

| Personal income tax relief on contributions made by employers, employees and the self-employed. | 42.5 |

| National insurance contribution (NIC) relief on employer contributions. | 15.4 |

| NIC relief on employee contributions. | 8.5 |

| Personal income tax relief on pension fund investment income. | 4.3 |

| less | |

| Personal income tax on payments from pension schemes. | (21.1) |

| Annual allowance charges | (0.3) |

| Lifetime allowances charges | (0.5) |

| TOTAL* | 48.7 |

*Figures do not total due to rounding

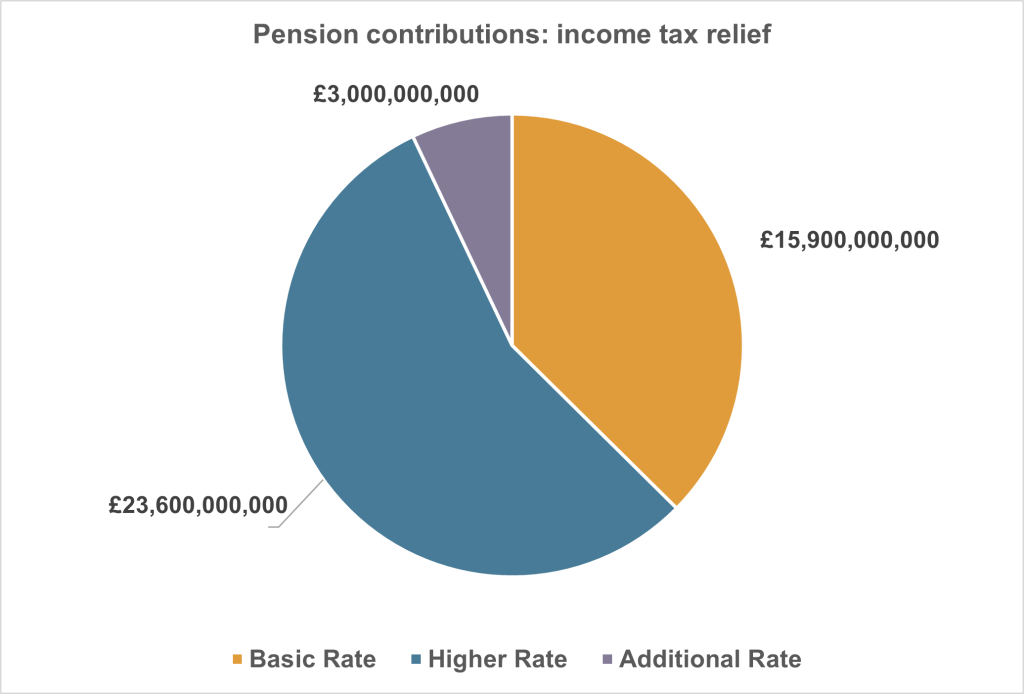

The standout element is the £42.5 billion of income tax relief on pension contributions, nearly two-thirds of which is claimed by higher and additional rate taxpayers (as shown in the ‘Pensions Contributions: Income Tax Relief’ pie chart above). The current freeze on personal allowance and higher rate thresholds, along with the near £25,000 reduction in the additional rate threshold in 2023/24, has likely exacerbated the skew.

In the words of many pre-Budget commentaries, pension contribution tax relief is a ‘low-hanging fruit’ for any chancellor looking for extra revenue. However, to date, the pickings have been limited to reducing the maximum tax-relievable contribution via the annual allowance rather than the rate of relief. This salami-slicing approach has created its own problems, notably among NHS consultants and senior doctors who were encouraged to choose early retirement or reduced hours rather than paying pension tax charges.

The possibility of cutting the rate of income tax relief is now being reconsidered by the Treasury, according to several media reports. For example, replacing the current system with a single 30% flat rate of relief would benefit most taxpayers (who currently receive 20% basic rate relief), but save the Exchequer about £3 billion a year.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing.