Financial Conduct Authority (FCA) publishes a review of the cash savings market following evidence of some dubious tactics at work.

While the use of paper cash is declining as a means of payment, the need to retain a cash reserve remains as strong as ever. We all need some ‘rainy day’ money in case of sudden expenses, from car repairs to the proverbial broken boiler (or heat pump). There is no universally agreed figure about how much we need, although ‘peace of mind’ figures between three and six months of income or regular outgoings are often suggested.

The latest data from the Bank of England shows that many of us appear to be holding much more than the six-month figure. Total household deposits amount to about £1,900 billion, or over an average of £65,000 per household. Viewed another way, it is enough stockpiled cash to clear about two-thirds of all government debt.

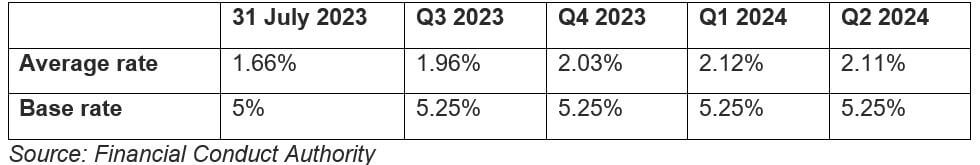

The size of the household cash mountain and Bank of England interest rates, which have been rising until recently, suggests why the FCA is paying growing attention to the rates being paid to depositors. As the table below from a September FCA report demonstrates, the gap between the official interest rate and average easy access rates is wide. The result is that the big banks have seen strong earnings, something which the Chancellor might seek to tax further in her forthcoming Budget.

Average easy access deposit interest rates and base rates at quarter end.

The FCA’s report highlighted three areas to watch if you have, or plan to, place money on deposit:

- Multiple tranches of accounts with identical terms and conditions, distinguished only by issue numbers (e.g. High Interest Account, Issue 9), that pay higher interest to new customers and not existing customers.

- Annually renewable bonuses where customers are required to register for a bonus to receive a better deal.

- Regressive interest rate tiering, where a lower rate is paid on deposits above a certain level (e.g. 5% on the first £2,000 and 1% on any amount above).

Interest rates are now generally on a downward path around the world. As well as watching out for the trio of tripwires above, it is also worth considering the alternatives to deposits, particularly if you have a surplus in that rainy day fund.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Content correct at the time of writing.