The Institute for Fiscal Studies (IFS) has been crunching the numbers on the adequacy of pension contributions.

One of the unremarked government successes of the 2010s was the introduction of automatic enrolment of employees into pension schemes. The first automatic enrolment contributions were made in October 2012 under the coalition government. However, the thinking behind the scheme was rooted in the Pensions Commission, which was set in motion by the previous Labour government at the end of 2002.

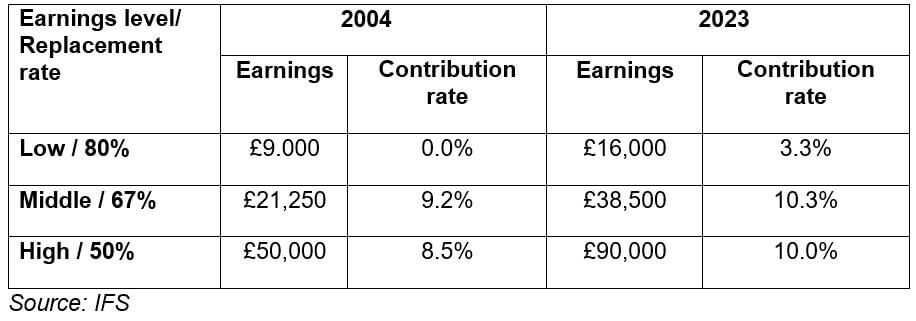

The Commission produced a series of weighty reports, the first one of which emerged in 2004. One of the important elements of the first report were two tables:

- The first showed the percentage of earnings that were required in retirement for various earnings bands. For example, at the middle earner level (£17,500 – £24,999 in 2004), the Commission set the replacement percentage at 67%.

- Using the replacement rates as a target and taking account of what the State would provide, the Commission then produced a table showing the level of private pension contributions required at different ages for each earnings band.

The Pensions Commission replacement rates relied on detailed assumptions, but were robust enough to convince politicians on all sides that there was a route to achieving adequate retirement income that was affordable and, crucially, did not need state funding.

Twenty years on, the Institute for Fiscal Studies has revisited the Pensions Commission’s tables and recalculated them allowing for:

- current investment assumptions pre- and post-retirement;

- substantially different structure of State Pension provision;

- today’s assumptions about real (post-inflation) earnings growth; and

- current and projected future mortality rates.

The results are shown below, based on an individual aged 22 in 2023, retiring at State Pension age (currently set at 68 in 2069).

These contribution rates apply to full earnings, unlike the current auto-enrolment rules which levied – at a minimum of 8% – only on earnings between £6,240 and £50,270. The message from the IFS table is one common among pension experts: auto-enrolment contributions alone are not enough.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Content correct at the time of writing.