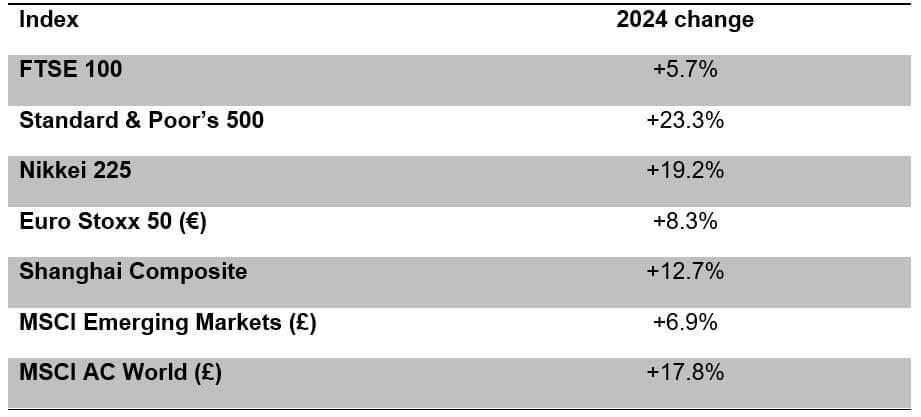

The global market outlook showed an improvement for 2024 with the US achieving more than 20% returns for a second consecutive year.

A quick look at a table comparing changes across key global indices puts the UK, as represented by the FTSE 100, in a relatively poor light. Figures suggest that the government has its work cut out persuading pension funds to divert more of their capital to UK companies, rather than the locomotive that is the US stock market.

However, there are nuances that a simple annual performance table misses:

- The level of dividends on the UK stock market is generally higher than in other markets. This normally does not show up in index performance tables, as most indices only measure capital growth. Add in dividends and the total return on the FTSE 100 in 2024 was a more respectable 9.7%.

- The US stock market, as measured by the S&P 500, produced another powerful performance in 2024. Much of that was due to the so-called Magnificent Seven technology shares – Amazon, Apple, Alphabet (aka Google), Meta, Microsoft, Nvidia and Tesla. Together, those seven companies account for about one third of the value of the 500-company S&P 500. The significance of the Magnificent Seven becomes apparent when an alternative version of the S&P 500 is considered which gives every company the same index weight, meaning the septet becomes just 1.4% (7/500) of the index. In 2024, that equal-weighted index grew by 10.9%, not 23.3% of the main index.

- Often overlooked in index tables is the effect of currency – indices are normally quoted in local currencies. So while the Euro Stoxx 50 appears to have outperformed the FTSE 100 in 2024, that is not the case if you are a sterling-based investor. Over the year, the euro fell 4.4% against the pound, more than enough to counter the higher euro-based index growth. There is a similar story for Japan, where the strong performance of Japanese shares was pared back by an 8.7% decline in the Japanese Yen against the pound.

One familiar lesson to draw from 2024 is that diversifying your investments across global markets makes sense – despite what the Chancellor might hope for.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing.