Inflation fell in 2024, dropping to 2.5% from 4.0% in 2023. So why didn’t it feel like that?

At the end of 2022, inflation in the UK, as measured by the Consumer Prices Index (CPI), was 9.2%, having reached a high of 11.1% in the previous October. In 2024, inflation ended the year at 2.5%, with the Bank of England’s target range of around 2%. The US has seen a similar pattern, although its peak was 9.1% in June 2022. Despite annual CPI inflation falling to 2% by the time of the 2024 elections, the cost of living was a major factor in why the incumbent party lost power in both countries.

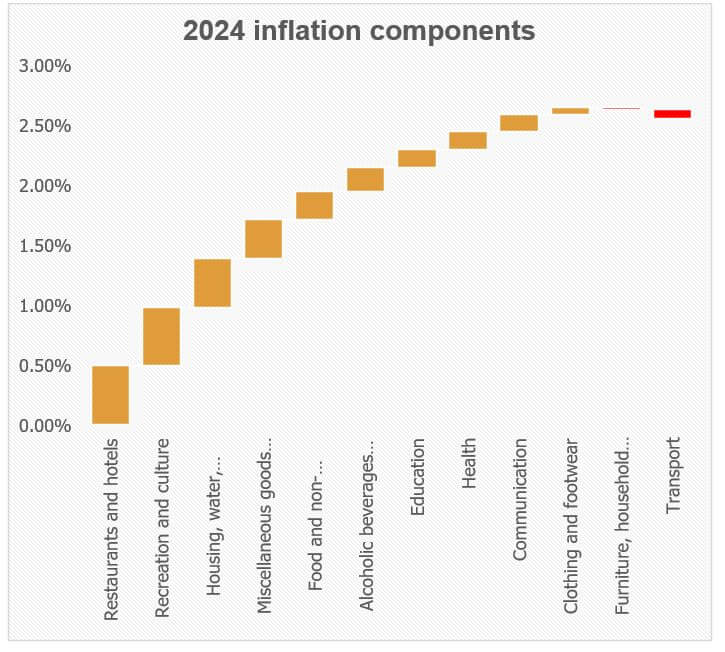

Those election results were a reminder that the economist’s view and the public’s view of inflation differ greatly. The economist has a strictly mathematical 12-month view, whereas public perceptions are longer term and often more focused on specific items. One way to understand this is to examine some of the detailed 2024 UK inflation annual figures and compare them with the three-year price increases (December 2021–December 2024).

Overall In 2024, CPI inflation was, as we said, 2.6%. However, over the three years, prices had risen in total by 17.4%, equivalent to 5.5% a year.

Food and non-alcoholic beverages This is a high-profile category, which has seen a whiplash pattern of inflation, soaring to 16.8% in 2022 and then plummeting to 2.0% in 2024. Over the three years, price increases totaled 28.7%, equivalent to 8.8% a year. Some items in this category experienced much sharper rises – oils and fats jumped nearly 56%.

Restaurants and Hotels This is the largest category in the CPI, accounting for about one seventh of the total ‘shopping basket’. Over three years it was up 23.2%, while in 2024 it added 3.4%, making it the largest contributing category to 2024 inflation.

Transport If you guess this, you will almost certainly be wrong. Over the three years, transport costs rose in total by just 5.4% and in 2024 they fell remarkably to 0.6%. Most people remember the pump price jumps of the Ukraine war, but forget their unwinding, helped by freezes on fuel duty.

Whichever way you think about inflation, make sure your financial planning takes it into consideration.

Content correct at the time of writing.