One of the nation’s largest investment managers has examined investors’ attitudes in the UK relative to other major developed G7 nations with interesting results.

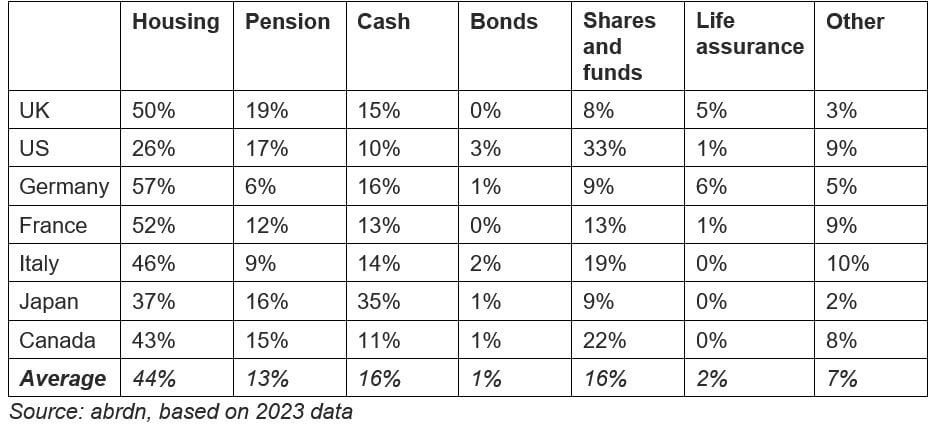

Personal wealth distribution

In recent years, Chancellors of both main political parties have spoken about encouraging investment in UK shares. Their focus has been on persuading pension funds to show more interest, not least because of billions held in retirement savings. The days of persuading Joe Public to become an equity investor through privatisation campaigns have long passed. Arguably, the most recent effort to stimulate individual investment in the UK stock market (individual savings accounts (ISAs)) has suffered years of benign neglect – the main contribution limit of £20,000 was last increased in 2017 and, following last year’s October’s Budget, is now set to remain at that level until at least April 2030.

It is perhaps unsurprising, therefore, that a recent report from abrdn, the investment managers, showed the UK placed last in the G7 in a table of individual share and mutual fund ownership. At the opposite end of the rankings was the US, where a third of individual wealth is riding on stock market assets.

The asset class of choice by far in the UK – and for European G7 members – is housing. Surveys regularly highlight the UK’s love of bricks and mortar. Research accompanying abrdn’s report revealed that almost half of UK adults prefer property as a long-term investment strategy over pensions.

Despite that view, the UK comes top in terms of pension asset ownership across the G7. The main driver behind that is probably UK State Pension provision, which is easily the worst in the G7 for an average earner. Even the US, not a country known for state welfare provision, delivers almost twice as much state pension, according to OECD research.

There is a case to be made for saying that the average UK individual, with almost two thirds of their wealth in cash and property, is too risk averse – as indeed are most Europeans. One reason for that may be financial literacy. In the US, products such as 401(k) pension plans have long created an awareness of investment in shares and the potential returns available.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing.