2025’s first set of inflation numbers were higher than expected, but more rises are coming.

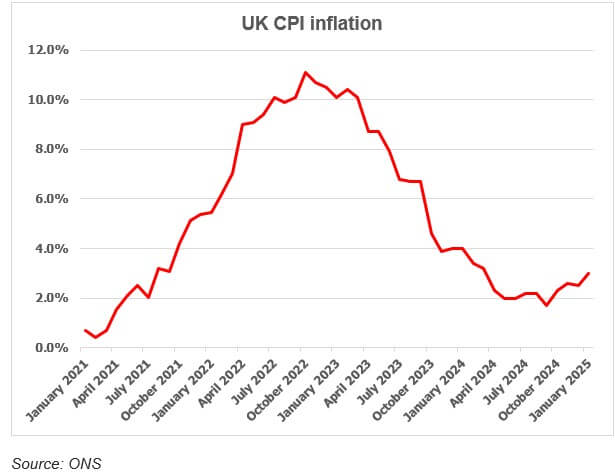

The UK has experienced an inflation rollercoaster since the start of this decade, as have many Western economies. In January 2020, the annual increase in the UK Consumer Prices Index (CPI) was 1.8%, but by July 2022 it had crossed 10% on its way to a peak of 11.1% in October of that year. As the graph shows, since then inflation has gone into a decline that closely mirrored the pace of the previous rise. In September last year, the annual CPI figure was down to 1.7% – virtually back to the level started in 2020.

That may have been an inflexion point, with February 2025 producing two surprises:

- When the Bank of England announced its latest rate cut to 4.5%, it also said it expected inflation to reach 3.7% in the third quarter of the year, “even as underlying domestic inflationary pressures are expected to wane further”

- Just under a fortnight later, the Office for National Statistics revealed the January CPI annual rate was 3.0%, 0.5% higher than in December 2024 and more than analysts had expected.

April will mark the arrival of further inflationary impetus:

- The Autumn Budget’s increase in employer’s National Insurance Contributions will start to take effect. This will have the most impact on costs (and prices) for the retail and leisure sectors.

- Those same sectors will also face the further challenge of handling the 6.7% rise in the National Living Wage from 1 April (and higher increases for employees under age 21). This is not just an issue for the lowest paid, as employers will also have to adjust the pay of workers a little higher up the food chain.

- The Ofgem quarterly energy price cap will rise 6% in April, whereas a year previously it fell by about 12%. The net result will be that the cap is about 9% higher than a year ago.

- Water bills will rise on average by 26%, although there are significant regional differences.

Nobody is predicting a return to double-digit inflation, but 2025 is set to be another year that serves as a reminder that your financial planning cannot ignore inflation.

The information contained within this article is for guidance only and does not constitute financial advice