The Office for National Statistics has taken a fresh look at our mortality.

Roughly every two years, stories in the media tell us how many children will live to the age of 100. The latest projections are that 11.5% of boys and 17.9% of girls born in 2023 will become centenarians.

The prompt for these biennial tales is the Office for National Statistics (ONS), which publishes updated tables of UK life expectancies every other year. The ONS work draws on the latest mortality data and research-supported estimates of how rapidly life expectancy will improve in future years. The data not only provides a few clickbait headlines: it feeds into many areas of government policy, providing projections for the size and shape of the country’s population over the next 50 years.

SPA increases

One area where the ONS data has an impact is the thorny topic of increases in the State Pension Age (SPA). While the move to a SPA of age 67 is now set in stone (by April 2028), the timing of the next step to age 68 is yet to be finalised. Currently, legislation dating back to 2007 says the change will be made between 2044 and 2046. Since 2007, there have been two ‘periodic reviews’ on the subject, the first of which proposed 2037–39 and the second proposed 2041–43. Both prompted the same government response: the promise of a further (post-election) review.

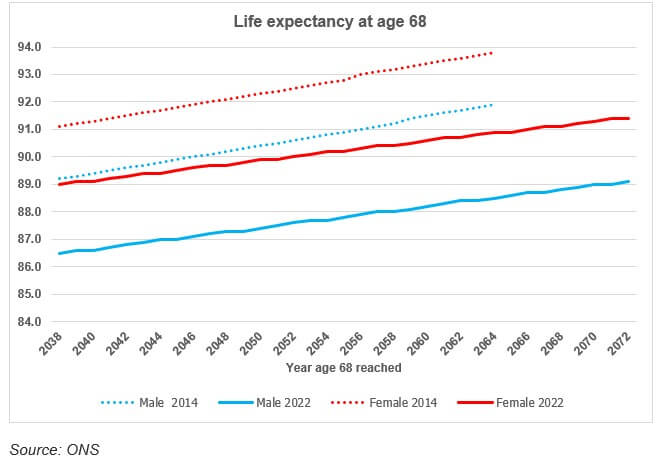

The next review is due by July 2026. As the government has promised to give at least a decade’s notice of any change, there is little time if 2037–39 is to be chosen. However, it now seems unlikely that a 2030s change will happen as illustrated by the graph above. When the first review was issued (in 2017), it drew on ONS projections (with a 2014 base year) which said that by 2038 a 68-year-old male and female could expect to live another 21.2 years and 23.1 years respectively. The latest ONS data (2022 base year) has cut those projections to 18.5 years and 21.0 years.

Those drops, which reflect a marked slowing in the speed of life expectancy improvement, suggest that the government may take the easy option and keep to the original 2044–46 schedule. They also imply the move to a SPA of 67 should be deferred, but there is little chance of that given the state of government finances.

Content correct at time of writing.