New research suggests some retirement costs have fallen, but there is a twist…

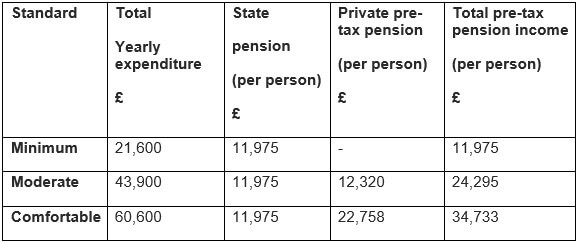

How much net income do you need each year for a minimum, moderate or comfortable living standard in retirement? Every year since 2019, the Pension and Lifetime Savings Association (PLSA), working in conjunction with Loughborough University, has provided the answer. In June, the PLSA published the latest calculations:

Table 1: PLSA income calculations on living standards 2023–2025

These figures are based on people living outside London; if you are in the metropolis, you can add between £1,300 and £3,200 a year for the privilege.

One notable change from 2023/24 is that the minimum standard figures have dropped significantly. The reason for this is somewhat arcane and now history. The PLSA figures are based on an April date, which means the 2024/25 figures benefited from the sharp fall in energy costs between April 2023 and April 2024. Since April 2024, energy costs have risen: the April 2025 Ofgem price cap was 9.4% higher than its April 2024 counterpart.

In any case, the chances are that you would not choose the minimum standard. In the words of the PLSA, the minimum standard “covers all your needs, with some left over for fun”. However, the fun is rather limited – the minimum standard assumes no car, a single week’s holiday in the UK and £30 a month per person spent on eating out. You would almost certainly prefer the comfortable standard, with a three-year-old small car, a fortnight four-star, half-board Mediterranean holiday plus three long UK weekend breaks, and £42 a week per person for eating out.

As Table 2 shows, the comfortable standard requires a large pension income – up to £5,225 per month after tax for two people living in London. This year, for the first time, the PLSA has spelt out the pre-tax pension required to reach each of its standards. Table 2 is for a two-person household outside London.

Now about that retirement planning review you have been putting off for so long…

The information contained within this article is for guidance only and does not constitute individual financial advice.

Content correct at time of writing.