Q3 2025 Update

The second quarter of 2025 began with a jolt as the US announced sweeping tariffs on all its trading partners. Dubbed “Liberation Day”, this sparked widespread market volatility and was followed by an escalation in the conflict between Israel and Iran, culminating in the US striking Iranian nuclear sites. The initial negative market impact of the trade war has been diluted by delays, exemptions and legal challenges and as a result markets have recovered.

The global economy is proving resilient in the face of these uncertainties with business and consumer activity (measured by PMIs) remaining in growth territory. In the US, a major fiscal stimulus, named the “One Big Beautiful Bill Act” will inject trillions into the economy. This, combined with declining trade uncertainty, sets the stage for stronger economic growth in the second half of 2025 and into 2026.

Inflation has risen gradually. However, the buildup of inventories prior to the announcement of tariffs, combined with consumers and corporates taking mitigating action, and goods inflation being a relatively small contributor to the inflation basket, suggests that any rise will be modest and short lived, and that a major inflationary shock will be avoided.

Geopolitical tensions remain high with events in the Middle East posing the latest risk. While the current Israel-Iran ceasefire is fragile, markets tend to adapt to geopolitical instability. We must therefore be conscious not to overreact and to stay level-headed and patient. The best approach during volatile periods is to remain invested and diversify across region, asset class, and investment style, within a global multi-asset portfolio.

Economic Outlook – Key Points

- Global growth remains resilient despite the trade war instigated by Trump. With expectations still low, we believe there is a meaningful probability global growth surprises to the upside in the coming quarters.

- Fiscal spending is a big driver of economic growth. Europe is ramping up defence and infrastructure spending. The EU has unlocked €800 billion, and Germany has announced a €500 billion infrastructure plan. Notably, China has raised its fiscal budget to the highest level in more than three decades.

- US dollar weakness, softening oil prices and falling interest rates are creating easier financial conditions and improved liquidity in the global economy.

- The Trump administration have implemented controversial polices in their first 6 months when their political capital is elevated. However, as time passes that capital is waning, and they will be incentivised to deliver market friendly policies such as deregulation, tax cuts and increasing oil production.

Market Outlook – Key Points

- Market volatility has declined sharply as uncertainty has reduced, but many investors remain on the sidelines. Institutional investors have reduced equity risk this year, and with c.$10 trillion sitting in cash funds globally, we see continued upside potential for markets.

- Investors will likely continue to question US exceptionalism. The uncertain policy environment in the US, combined with elevated US equity valuations, and a high 70% contribution to global indices, there is an increasing probability of capital flow from the US into other regional equity markets.

- Global (ex-US) equities including UK and Europe, as well as small and medium sized companies trade at a substantial discount, suggesting returns can broaden out into underappreciated markets, particularly if growth surprises to the upside and the gradual rate cutting cycle continues.

- Emerging market (EM) equities remain attractively valued, amid positive earnings revisions and a weaker US dollar. Momentum is building in Hong Kong and Chinese markets, and we expect more artificial intelligence (AI) ‘winners’ to emerge from China.

Key Risks to Outlook

1. Trade war risk – an escalation of the trade war is a clear risk, particularly given markets have recovered from the Liberation Day losses. Negotiations are ongoing and the signs suggest the final destination will be acceptable for markets.

2. Inflation “second wave” risk – after a sharp period of disinflation over 2023-24, the risk of rising inflation has increased with higher tariffs on many consumer goods.

3. Unemployment risk – unemployment rates have been rising gradually across Developed Market countries, although remain near low levels relative to historical ranges. Rising unemployment is the number one trigger for a recession.

4. Geopolitical risk – volatility will remain elevated as Trump executes his unpredictable America First agenda. We have seen some positive developments in the Middle East and a Ukraine ceasefire could be more likely.

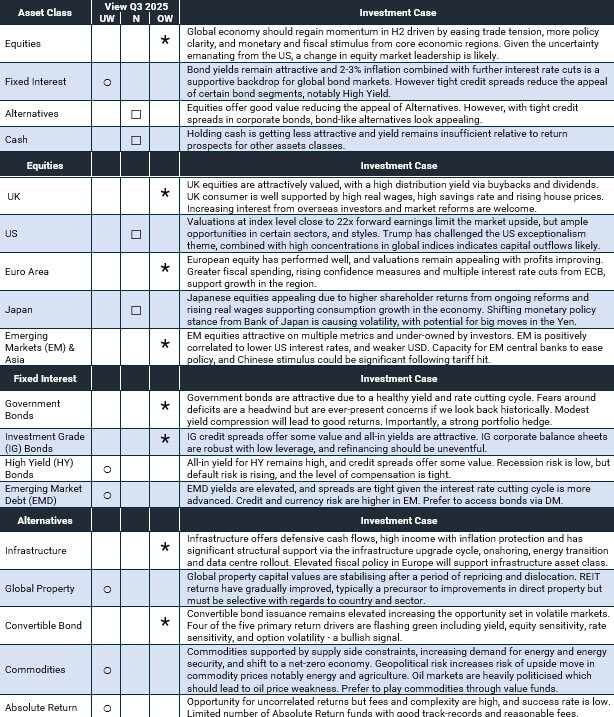

Quarterly Changes to Asset Allocation Views (Definitions for OW, UW, and N can be found at the end of article.)

We remain confident in our overweight (OW) equity position due to the likelihood of trade solutions and a return to growth, combined with sizeable monetary and fiscal stimulus in core economic regions. Regionally we are more optimistic about UK, European and Emerging Market Equities. We remain underweight (UW) in Fixed Interest, continuing to favour higher-quality investment grade corporate bonds and government bonds. We are also positive on specialist bond sectors, such as Corporate Hybrid Bonds that offer a higher income for investment grade type credit risk. Additionally, we have moved to neutral (N) in Alternative assets given credit spreads are tight in bonds and we have added a defensive bond-like alternative fund with a high yield to the portfolios.

- Overweight (OW) – favourable view of the asset class in the short-term and generally have a higher allocation relative to our long-term strategic allocation.

- Neutral (N) – balanced view of the asset class in the short-term and generally have a comparable allocation relative to our long-term strategic allocation.

- Underweight (UW) – less favourable view of the asset class in the short-term and generally have a lower allocation relative to our long-term strategic allocation.

Glossary

Alternatives: Alternatives are investments that fall outside the traditional asset classes (like stocks and bonds) and can include hedge funds, private equity, real estate, and commodities.

Asset classes: Asset classes are categories of investments that share similar characteristics and behave similarly in the marketplace, such as equities, bonds, cash, and real estate.

Bonds: Bonds are fixed-income securities that represent a loan made by an investor to a borrower (typically a corporation or government), where the borrower pays interest over a specified period and repays the principal at maturity.

Commodities: Commodities are raw materials or primary agricultural products that can be bought and sold, such as oil, gold, or wheat, and are often traded on exchanges.

Developed market: Developed markets are countries with well-established financial systems, high levels of income, and stable economies, such as the United States, Japan, and Germany.

Diversification: Diversification is an investment strategy that involves spreading investments across various asset classes or sectors to reduce risk and enhance potential returns.

Dividends: Dividends are payments made by a corporation to its shareholders, usually derived from profits, and can provide a source of income for investors.

Earnings per share (EPS): Earnings per share (EPS) is a financial metric that indicates a company’s profitability by dividing net income by the number of outstanding shares, reflecting how much money a company makes for each share owned.

Economic cycle: The economic cycle refers to the natural fluctuation of the economy between periods of expansion (growth) and contraction (recession), impacting employment, production, and consumer spending.

Emerging market: Emerging markets are countries with developing economies that are in transition from low income to more industrialized status, often characterized by rapid growth and volatility, such as India, Brazil, and China.

Equities: Equities represent ownership in a company, usually in the form of stocks, and give shareholders the right to a portion of the company’s profits and assets.

Fixed interest: Fixed interest refers to investments that pay a constant interest rate over a specified period, commonly associated with bonds, where the interest remains the same regardless of market fluctuations.

Inflation: Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power and typically measured by indices such as the Consumer Price Index (CPI).

Interest rates: Interest rates are the cost of borrowing money, expressed as a percentage of the principal, which can influence mortgage rates, consumer spending, business investment, and overall economic activity.

Macro: Macro, short for macroeconomics, refers to the branch of economics that studies the behaviour and performance of an economy as a whole, focusing on issues like growth, inflation, and unemployment.

Overweight/Underweight: Overweight and underweight refer to the strategy of holding a larger or smaller percentage of a specific asset or asset class in a portfolio compared to a benchmark, indicating a belief in its potential for better or worse performance.

Property: Property refers to real estate investments, which can include residential, commercial, or industrial buildings, and can generate income through rents or appreciation in value.

Stimulus/Policy: Stimulus refers to government measures, often in the form of fiscal or monetary policy, aimed at boosting economic activity, such as lowering interest rates or increasing government spending.

Stocks: Stocks are shares of a company that can be bought and sold, representing a claim on part of the company’s assets and earnings.

Valuations: Valuations refer to the process of determining the current worth of an asset or a company, often using metrics like price-to-earnings ratios or discounted cash flow analysis.

Important information

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Information was obtained from proprietary and non-proprietary sources deemed reliable by Chase de Vere.

Where the qualified Investment Manager has expressed views and opinions, they are based on current market conditions and their professional judgement and are subject to change.

The information contained within this update is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

Prices were correct at the time of writing.