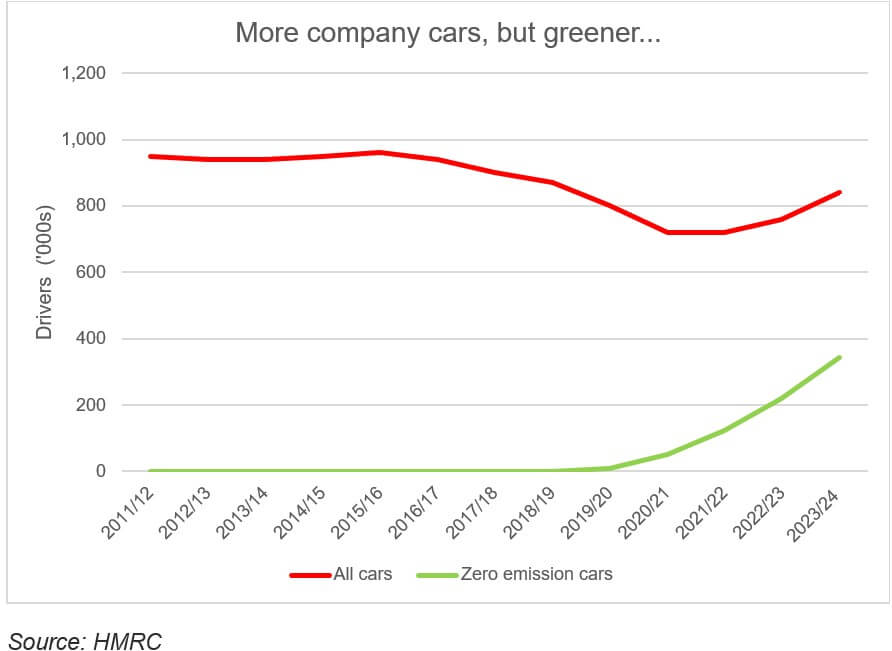

New research from HMRC show company cars are becoming more common – and greener.

Recent statistics issued by HMRC show that company car ownership (the top line) is enjoying a revival after a 25% fall between 2015/16 and 2020/21. The reason for the increase is largely explained by the second line, which shows electric company car ownership.

As recently as 2018/19, less than one company car in two hundred was a zero-emission vehicle:

- By 2023/24 (the latest data), the proportion had changed to about two in every five.

- Over the same period, the diesel share of the company car population dropped from over two in three to just one in eight.

The switch to green does not signify that company car drivers are becoming environmentalists over the decade. Instead, it is a clear demonstration of how tax changes can drive behavioural change:

- In April 2017, HMRC introduced a new approach to taxing company cars that were provided under salary sacrifice or similar arrangements. In many instances, the new regime, called Optional Remuneration Arrangement (OpRA), made salary sacrifice less attractive because it ended up basing the personal tax on the company car regime rather than, as previously, the amount of salary foregone. To encourage take-up of low-emission cars, an exclusion was carved out for cars with CO2 emissions of up to 75g/km (of which there were very few at the time).

In 2020/21, the benefit-in-kind percentage charge on zero-emission cars was cut from 16% to 0%. Thereafter, for the next two years, it rose by 1% a year, reaching 2% in 2022/23 and staying at that level until a further 1% rise to 3% for the current tax year, 2025/26. In contrast, a petrol car with 100g/km of CO2 emissions saw its scale percentage rise marginally from 24% in 2019/20 to 25% currently.

The combination of inducements has proved almost too successful: the total taxable value of all company cars fell from £5.43 billion in 2019/20 to £3.27 billion in 2023/24. Now, however, the percentage scale charge for zero-emission cars is on the increase and by 2029/30, it will be 9% – three times the current level. It may still be worth considering salary sacrifice for an electric company car, but the tax calculations will not be as favourable.

The information contained within this article is for guidance only and does not constitute individual financial advice.

Tax treatment varies according to individual circumstances and is subject to change. The Financial Conduct Authority does not regulate tax advice.

Content correct at time of writing.