Buy-to-let investors will be hit by another notch up of the tax ratchet.

Source Nationwide

When George Osborne announced in his summer 2015 Budget a variety of tax changes aimed at discouraging buy-to-let (BTL) investment, they came as a surprise. To ease their impact, the then Chancellor phased in the most significant reform, a revised treatment of interest relief, over four years and deferred its start date to April 2017. Anecdotal evidence suggests some BTL investors did not know what had happened until they found a larger than expected tax bill in January.

April 2019 will see the start of the third year of the phasing process, which will mean in 2019/20:

- Three quarters of any interest paid on BTL borrowing will be eligible for a 20% tax credit; and

- The balance of interest is deductible from rental income, meaning it is fully tax relievable.

If that all sounds rather arcane, the impact becomes more obvious when you look at a simplified example. Suppose a higher rate taxpayer had rental income of £12,000 and interest on a BTL mortgage of £8,000. The investors’ net income position is as follows:

| Tax Year | Rent | Interest | Rent – Interest | Tax Due | Net Income |

| £ | £ | £ | £ | £ | £ |

| 2016/17 | 12,000 | 8,000 | 4,000 | -1,600 | 2,400 |

| 2017/18 | 12,000 | 8,000 | 4,000 | -2,000 | 2,000 |

| 2018/19 | 12,000 | 8,000 | 4,000 | -2,400 | 1,600 |

| 2019/20 | 12,000 | 8,000 | 4,000 | -2,800 | 1,200 |

| 2020/21 | 12,000 | 8,000 | 4,000 | -3,200 | 800 |

In practice, the situation might be worse than the table suggests if, for example, the disappearance of the deduction for interest increases the investor’s gross income to the point that it trips over the £100,000 threshold, at which the personal allowance is phased out.

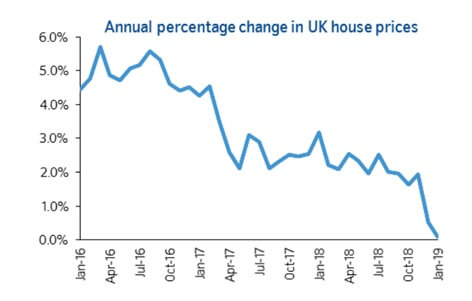

Sales by BTL investors could pick up this year due to the interest relief changes and poor short-term prospects for capital growth. There is another tax incentive to sell on the horizon, too. From April 2020, capital gains tax on residential property (at 18% and/or 28%) will have to be paid within 30 days of sale, whereas the current rules effectively give a minimum of nearly ten months’ grace.

If you are a BTL investor and are considering leaving the market, please talk to us about your options, on both the tax planning and reinvestment fronts.

The value of tax reliefs depends on your individual circumstances.Tax laws can change.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

The Financial Conduct Authority does not regulate commercial buy to lets or tax advice.

Content correct at time of writing and is intended for general information only and should not be construed as advice